Achieve Your Financial Goals: The Power of an Income and Expense Tracker Printable

maris wariShare

In today's fast-paced world, achieving financial goals can seem like a daunting task.

Whether you're saving for a big purchase, paying off debt, or planning for retirement, staying on top of your finances is essential.

Fortunately, there's a simple and effective tool that can help you achieve your financial goals: an income and expense tracker printable.

What Is an Income and Expense Tracker Printable?

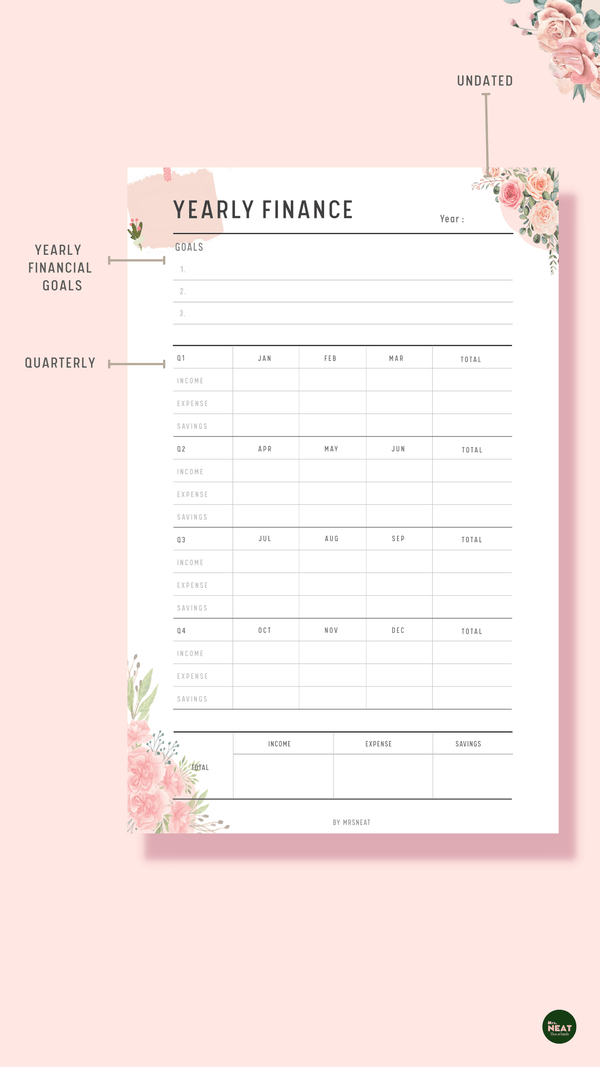

An income and expense tracker printable is a tool that allows you to record and monitor your income and expenses.

It typically includes sections for your income sources, such as your salary or any additional income you may have, as well as your expenses, such as rent, utilities, groceries, and entertainment.

It also allows you to track your savings and debt payments.

An income and expense tracker printable is a valuable tool for managing your finances effectively.

Here are some reasons why you might need one:

Budgeting #1

An income and expense tracker printable helps you create and stick to a budget.

It allows you to see where your money is going and identify areas where you can cut back or make changes.

Financial Goals #2

An income and expense tracker printable can help you set and achieve financial goals.

Whether you're saving for a vacation, a down payment on a house, or retirement, you can use your tracker to monitor your progress and stay on track.

Debt Management #3

If you have debt, an income and expense tracker printable can help you manage it more effectively.

You can track your debt payments and see how much progress you're making toward paying off your debt.

Increased Awareness #4

An income and expense tracker printable increases your awareness of your financial situation.

By recording your income and expenses, you can see where your money is going and identify areas where you can cut back or make changes.

Peace of Mind #5

Finally, an income and expense tracker printable can give you peace of mind knowing that you're in control of your finances.

By staying on top of your income and expenses, you can avoid financial surprises and make informed decisions about your money.

Overall, an income and expense tracker printable is a valuable tool for managing your finances effectively.

Whether you're budgeting, setting financial goals, managing debt, increasing awareness, or seeking peace of mind, a tracker can help you achieve your financial goals and take control of your financial future.

An income and expense tracker printable can be beneficial for a wide range of individuals, including:

Individuals on a Budget #1

People who are looking to budget their finances more effectively can benefit from an income and expense tracker printable.

It can help them track their income and expenses, identify areas where they can cut back, and stay on track with their financial goals.

People with Financial Goals #2

Individuals who have specific financial goals, such as saving for a vacation, a down payment on a house, or retirement, can benefit from an income and expense tracker printable.

It can help them monitor their progress and make informed decisions about their money.

People with Debt #3

Individuals who have debt can benefit from an income and expense tracker printable.

It can help them manage their debt more effectively, track their debt payments, and see how much progress they're making toward paying off their debt.

People Who Want to Increase Their Awareness #4

Individuals who want to increase their awareness of their financial situation can benefit from an income and expense tracker printable.

It can help them see where their money is going and identify areas where they can cut back or make changes.

People Who Want Peace of Mind #5

Finally, individuals who want peace of mind knowing that they're in control of their finances can benefit from an income and expense tracker printable.

By staying on top of their income and expenses, they can avoid financial surprises and make informed decisions about their money.

Overall, an income and expense tracker printable can be beneficial for a wide range of individuals who are looking to manage their finances more effectively, set and achieve financial goals, manage debt, increase awareness, and seek peace of mind.

You may need an income and expense tracker printable if you find yourself in any of the following situations:

You're Struggling to Stay on Budget #1

If you're having trouble sticking to your budget or you're not sure where your money is going each month, an income and expense tracker printable can help you track your spending and identify areas where you can cut back.

You're Trying to Save for a Specific Goal #2

Whether you're saving for a vacation, a down payment on a house, or retirement, an income and expense tracker printable can help you monitor your progress and stay on track with your savings goals.

You Have Debt #3

If you have debt, an income and expense tracker printable can help you manage your debt more effectively by tracking your debt payments and seeing how much progress you're making toward paying off your debt.

You Want to Increase Your Financial Awareness #4

If you want to increase your awareness of your financial situation and make more informed decisions about your money, an income and expense tracker printable can help you see where your money is going and identify areas where you can cut back or make changes.

You Want Peace of Mind #5

Finally, if you want peace of mind knowing that you're in control of your finances and you're not going to be surprised by any unexpected expenses, an income and expense tracker printable can help you stay on top of your income and expenses and avoid financial surprises.

Overall, you may need an income and expense tracker printable if you're looking to manage your finances more effectively, set and achieve financial goals, manage debt, increase awareness, and seek peace of mind.

Related Articles;

- Master Your Finances With Our Budget Breakdown Planner

- Master Your Finances with Our Monthly Budget Planner

- The Ultimate Financial Planner Bundle: Essential Tools for Mastering Your Finances

The Benefits of an Income and Expense Tracker Printable

Increased Awareness #1

One of the key benefits of using an income and expense tracker printable is that it increases your awareness of your financial situation.

By recording your income and expenses, you can see where your money is going and identify areas where you can cut back or make changes.

Better Budgeting #2

An income and expense tracker printable allows you to create a budget that works for you.

You can set spending limits for different categories, such as groceries or entertainment, and track your progress throughout the month.

Financial Goals #3

An income and expense tracker printable can also help you set and achieve financial goals.

Whether you're saving for a vacation, a down payment on a house, or retirement, you can use your tracker to monitor your progress and stay on track.

Debt Management #4

If you have debt, an income and expense tracker printable can help you manage it more effectively.

You can track your debt payments and see how much progress you're making toward paying off your debt.

Peace of Mind #5

Finally, an income and expense tracker printable can give you peace of mind knowing that you're in control of your finances.

By staying on top of your income and expenses, you can avoid financial surprises and make informed decisions about your money.

Certainly! Here are another 20 benefits of using an Income and Expense Tracker Printable:

Tracking Spending #6

Allows you to track your spending and identify areas where you can cut back.

Savings #7

Helps you monitor your savings and stay on track with your savings goals.

Expense Analysis #8

Allows you to analyze your expenses and make informed decisions about your money.

Avoiding Financial Surprises #9

Helps you avoid financial surprises by staying on top of your income and expenses.

Financial Planning #10

Helps you plan for your financial future.

Emergency Funds #11

Helps you build and maintain an emergency fund.

Retirement Planning #12

Allows you to plan for retirement and monitor your progress.

Investment Tracking #13

Helps you track your investments and see how they're performing.

Tax Planning #14

Helps you plan for taxes and keep track of deductible expenses.

Financial Awareness #15

Increases your awareness of your financial habits and patterns.

Financial Independence #16

Helps you achieve financial independence and freedom.

Reducing Stress #17

Reduces stress by helping you manage your finances more effectively.

Building Wealth #18

Helps you build wealth over time.

Financial Education #19

Provides you with an education in personal finance.

Financial Literacy #20

Increases your financial literacy and understanding of financial concepts.

Financial Control #21

Gives you control over your finances and your financial future.

Financial Security #22

Helps you build financial security for yourself and your family.

Financial Confidence #23

Increases your confidence in managing your finances.

Financial Accountability #24

Holds you accountable for your financial decisions and actions.

Financial Independence #25

Helps you achieve financial independence and freedom.

How to Use an Income and Expense Tracker Printable

Using an income and expense tracker printable is simple. Start by recording your income sources and expenses at the beginning of each month.

Throughout the month, update your tracker as you receive income and make purchases.

At the end of the month, review your tracker to see where you stand financially and make any necessary adjustments to your budget.

Using an income and expense tracker printable is a great way to manage your finances and achieve your financial goals.

Here's a step-by-step guide to help you get started:

Download or Create Your Tracker #1

Start by downloading an income and expense tracker printable here.

Set Up Your Tracker #2

Set up your tracker by entering your income sources and expense categories.

This will help you organize your finances and make it easier to track your spending.

Enter Your Income #3

Begin by entering your income sources into your tracker.

This can include your salary, any additional income you may have, and any other sources of income.

Enter Your Expenses #4

Next, enter your expenses into your tracker.

This can include rent or mortgage payments, utilities, groceries, transportation, entertainment, and any other expenses you may have.

Record Your Transactions #5

As you make purchases or receive income, record the transactions in your tracker.

Be sure to include the date, the amount, and the category (income or expense) for each transaction.

Categorize Your Expenses #6

Categorize your expenses into different categories, such as housing, transportation, groceries, and entertainment.

This will help you see where your money is going and identify areas where you can cut back.

Track Your Spending #7

Keep track of your spending throughout the month by recording each transaction in your tracker.

This will help you stay on top of your finances and avoid overspending.

Review Your Tracker #8

At the end of each month, review your tracker to see where your money is going and how you're doing compared to your budget.

This will help you make any necessary adjustments to your spending and stay on track with your financial goals.

Make Adjustments #9

If you find that you're overspending in certain categories, look for ways to cut back.

This might involve reducing your discretionary spending, finding ways to save on your fixed expenses, or finding ways to increase your income.

Set Goals #10

Finally, use your tracker to set financial goals for yourself.

Whether you're saving for a vacation, a down payment on a house, or retirement, setting goals can help you stay motivated and focused on your financial future.

By following these steps and using an income and expense tracker printable, you can take control of your finances and achieve your financial goals.

Remember to review your tracker regularly, make any necessary adjustments to your spending, and stay focused on your goals.

With a little effort and discipline, you can achieve financial success and build a secure future for yourself and your family.

An income and expense tracker printable is a powerful tool that can help you achieve your financial goals.

By increasing your awareness of your finances, helping you create a budget, and tracking your progress, it can give you the confidence and peace of mind to take control of your financial future.

https://www.linkedin.com/in/mariswari/

https://www.linkedin.com/in/mariswari/