How to Save $10,000 in a year with 10 Simple Real Ways

maris wariShare

Achieving financial goals like saving $10,000 in a year is more than just a number on a page—it's a journey towards financial stability and independence.

In this article, let's delve into practical and actionable steps that anyone can take to reach this significant savings milestone.

From budgeting tips to creative ways to boost your income, this guide will empower you to take control of your finances and work towards a brighter financial future.

Here, we will explore the strategies, mindset shifts, and habits that can help you save $10,000 in a year and set yourself up for long-term financial success.

Here are some key elements to help you reach your savings goal:

Set a Clear Goal #1

Define why you want to save $10,000 and what it means to you.

Having a specific goal in mind will help you stay motivated and focused.

For me, I want to save $10,000 to build an emergency fund that will provide financial security and peace of mind for unexpected expenses.

This fund will serve as a safety net for me and my family, allowing us to handle emergencies without going into debt or experiencing financial stress.

Achieving this savings goal will give me a sense of financial stability and confidence in my ability to handle any unforeseen circumstances that may arise.

By clearly articulating why you want to save $10,000 and what it means to you—whether it's for an emergency fund, a specific purchase, or a future goal—you provide yourself with a strong motivation to stay committed to your savings plan throughout the year.

Create a Realistic Budget #2

Track your income and expenses to understand where your money is going.

Create a detailed budget that allocates a portion of your income towards savings each month.

Cut Unnecessary Expenses #3

Identify expenses that are not essential and look for areas where you can cut back.

This could include dining out less, canceling unused subscriptions, or finding more affordable alternatives.

For me, I examine my monthly expenses and identify that I spend an average of $200 per month on dining out at restaurants.

To cut back on this expense and save money, I decide to make some changes.

Instead of dining out multiple times a week, I set a goal to dine out only once a week as a special treat.

I also commit to preparing more meals at home and bringing lunch to work instead of buying it.

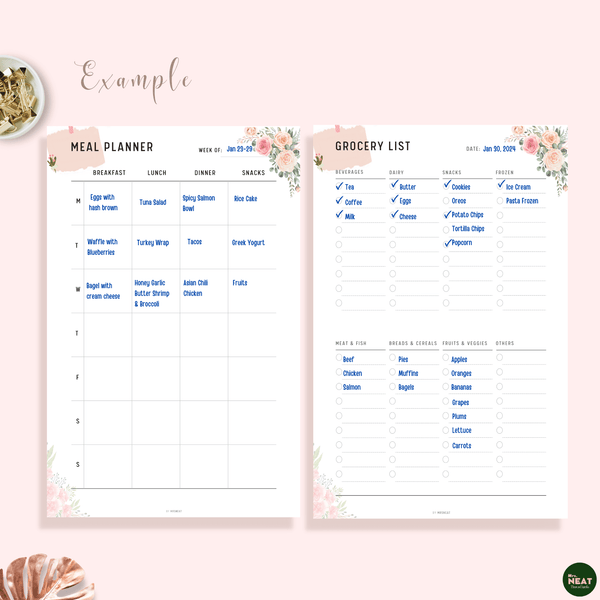

These weekly meal planner and grocery list planner had help me to achieve my goal to save more money!

Additionally, I realize that I have several subscription services that I’m not actively using, such as streaming services, gym memberships, or magazine subscriptions, totaling $50 per month.

I decide to cancel these subscriptions and only retain the ones that you truly value and use regularly.

This simple change saves me an additional $600 per year.

By making these adjustments and being mindful of my spending habits, I manage to free up $250 per month ($200 from dining out and $50 from canceled subscriptions), which adds up to $3,000 in savings over the course of a year.

This newfound savings can now be allocated towards your goal of saving $10,000, putting you well on your way to reaching your target by the end of the year.

Automate Your Savings #4

Set up automatic transfers from your checking account to your savings account.

Automating your savings ensures that a portion of your income goes towards your goal without you having to think about it.

Track Your Progress #5

Regularly monitor your savings progress to stay on track. Seeing how far you've come can be motivating and help you make any necessary adjustments to your saving strategy.

I use a 52-week money-saving challenge printable to track my progress towards saving $10,000 in a year.

In this challenge, I commit to savings amount each week.

By following this savings plan, I will have saved a total of $10,000 at the end of the year.

As you complete each week of the challenge, you can mark off your progress on the printable.

Watching your savings grow week by week can be motivating and visually see your advancement towards your goal.

By the end of the year, not only will you have saved $10,000 but you'll also have developed a consistent saving habit that can benefit your financial well-being in the long run.

Set Milestones #6

Break down your $10,000 savings goal into smaller milestones.

Celebrate each milestone you reach to stay motivated throughout the year.

Earn Extra Income #7

Consider ways to increase your income, such as taking on a side hustle, freelancing, or selling items you no longer need.

The additional income can accelerate your savings progress.

I currently work a full-time job but are looking to boost my income to reach my savings goal.

I explore different ways to earn extra money outside of my regular job such as :

Freelancing Services

I can do graphic design, so I decide to offer my services on freelance platforms like Upwork or Fiverr.

By taking on projects in my spare time, I can earn additional income based on my skills and expertise.

Online Tutoring

Or if you are proficient in a particular subject, such as math or English.

You might start tutoring students online through platforms like Chegg Tutors or Wyzant, helping them with their studies and earning extra money for each session.

Selling Handmade Crafts

I enjoy making planner template in my free time and decide to turn my hobby into a side business. I create my planner and sell on platforms like Etsy, Gumroad, generating a source of passive income from my creations.

Part-Time Job

You might find a part-time job at a local store or restaurant that offers flexible hours outside of your main job.

This allows you to earn additional income through hourly wages or tips, increasing your total earnings each month.

Renting Out Space

If you have a spare room in your home or a vacation property, you consider renting it out on platforms like Airbnb.

By hosting guests, you can generate extra income from rental fees while meeting new people and sharing your space.

By exploring these avenues to earn extra income, you can supplement your primary source of earnings and accelerate your progress towards saving $10,000 in a year.

Each additional dollar you earn through these side hustles contributes to your savings goal, bringing you closer to achieving financial success and stability.

Related article

- Building Multiple Streams of Income for Lasting Financial Freedom

- How to Achieve Financial Freedom through Minimalism: Less is More

- Financial Freedom in the Digital Age: Leveraging Technology for Success

Avoid Impulse Purchases #8

Before making a purchase, especially a larger one, take a moment to consider if it aligns with your savings goal.

Avoiding impulse purchases can help you stay on track with your saving plan.

Whenever I’m walking through a store and I see a trendy gadget that catches your eye.

My initial impulse is to buy it, even though it's not something I truly need.

Instead of giving in to the temptation to make an impulse purchase, I decide to implement a simple strategy to curb these spontaneous buying urges.

Before making any non-essential purchase, I create a "cooling-off" period for myself.

This involves taking a step back and giving myself 24 hours to think about whether the purchase is necessary and aligns with your savings goal of $10,000.

During this time, I ask myself questions such as:

Do I really need this item, or is it just a want?

Will this purchase bring me long-term value and satisfaction?

Can this money be better allocated towards my savings goal?

By pausing and reflecting before making a purchase, I give myself the opportunity to evaluate whether the item is worth spending your hard-earned money on.

More often than not, I may find that the urge to buy dissipates after the cooling-off period, leading me to make more mindful spending choices.

This approach helps me prioritize my savings goal and avoid unnecessary expenses that could hinder my progress towards saving $10,000 in a year.

Meal Prep and Cook at Home #9

Eating out can be a significant expense. By meal prepping and cooking at home, you can save money on food costs and allocate those savings towards your goal.

Related article :

- Healthy Eating on a Budget: How a Weekly Meal Planner Can Help You Save Money

- Simplify Your Grocery Budget: Save Money with a Weekly Meal Planner and Grocery Shopping List Tracker

- How a Meal Planner Printable and Recipe Page Printable Transformed My Life Routine

Stay Committed #10

Saving $10,000 in a year requires commitment and perseverance.

Stay focused on your goal, remind yourself of why you're saving, and celebrate your progress along the way.

By implementing these strategies, adopting a positive money mindset, and cultivating good saving habits, you can set yourself up for success in saving $10,000 in a year.

Remember, small consistent steps can lead to significant savings over time.

https://www.linkedin.com/in/mariswari/

https://www.linkedin.com/in/mariswari/