12 Real Way to Help You Save $1000 Every Month in 2024

maris wariShare

Saving money is an essential financial habit that can help us achieve our short-term and long-term financial goals.

Here's why we should consider saving $1,000 every month:

Emergency Fund

Having a well-funded emergency fund can provide you with financial security and peace of mind.

An emergency fund can help you cover unexpected expenses like medical bills, car repairs, or home repairs without having to rely on credit cards or loans.

Related Content :

- Building an Emergency Fund : Your Safety Net to Financial Freedom

- How a Printable Budget Tracker Can Transform Your Finances

Financial Independence

Saving money can help you achieve financial independence.

By building up your savings, you can create a financial safety net that allows you to take risks, pursue opportunities, and live life on your own terms.

Retirement Planning

Saving money can help you prepare for retirement.

By contributing to retirement accounts like a 401(k) or IRA, you can build up a nest egg that will provide you with income in retirement.

Debt Repayment

Saving money can help you pay off debt.

By setting aside money each month, you can make extra payments on your debt and pay it off faster.

Financial Goals

Saving money can help you achieve your financial goals.

Whether you're saving for a down payment on a house, a vacation, or a new car, having a savings plan in place can help you reach your goals faster.

Peace of Mind

Saving money can provide you with peace of mind.

Knowing that you have money set aside for emergencies, retirement, and other financial goals can help you feel more secure and less stressed about your finances.

Overall, saving money is an important financial habit that can help us achieve our financial goals, prepare for the future, and provide us with peace of mind.

By saving $1,000 every month, we can build up your savings, prepare for emergencies, and work towards achieving our financial goals.

Here are 12 practical ways to save $1000 every month:

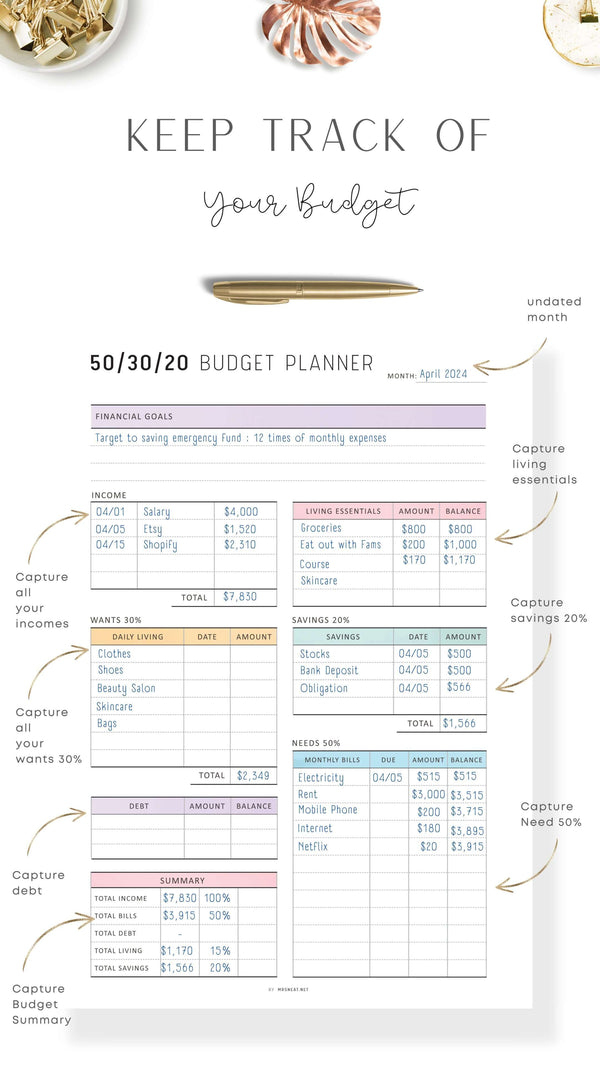

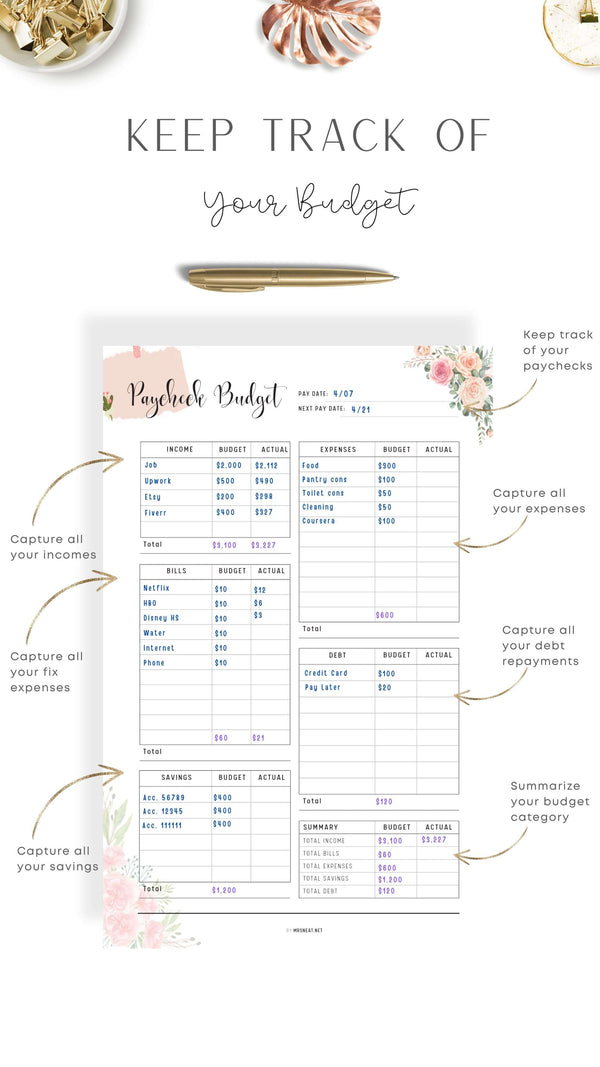

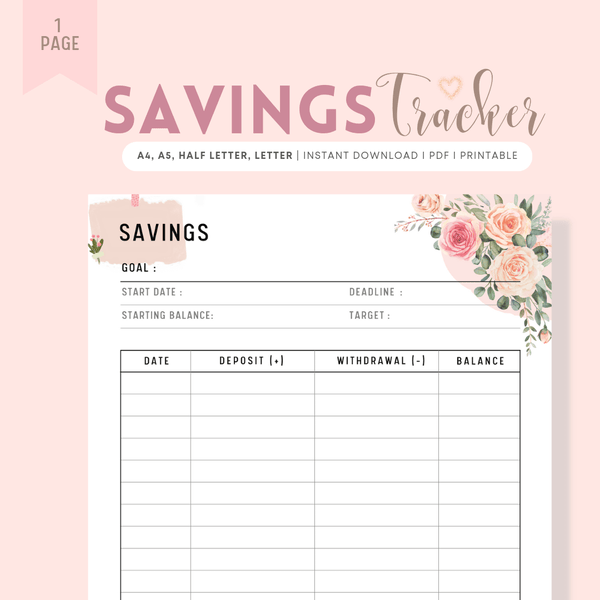

Create a detailed budget and stick to it #1

Creating a detailed budget and sticking to it can be a great way to manage your finances effectively.

Here are some steps to help you create and stick to a budget:

Set your financial goals #1

Determine what you want to achieve with your budget, whether it's saving for a big purchase, paying off debt, or building an emergency fund.

Calculate your income #2

List all your sources of income and determine your total monthly income.

List your expenses #3

Create a list of all your expenses, including fixed expenses (like rent or mortgage payments) and variable expenses (like groceries, entertainment, etc.).

Differentiate between needs and wants #4

Prioritize your expenses by separating needs (essential expenses) from wants (non-essential expenses).

Set spending limits #5

Allocate a specific amount of money to each expense category based on your income and financial goals.

Track your spending #6

Record your expenses regularly to see where your money is going and to ensure you stay within your budget.

Review and adjust #7

Regularly review your budget to see if you're on track with your financial goals. Make adjustments as needed based on your spending patterns.

Stay disciplined #8

Stick to your budget by being mindful of your spending habits and making conscious decisions when it comes to purchases.

Use budgeting tools #9

Consider using budgeting apps or spreadsheets to help you track your expenses and stay organized.

By following these steps and staying committed to your budget, you can better manage your finances and work towards achieving your financial goals.

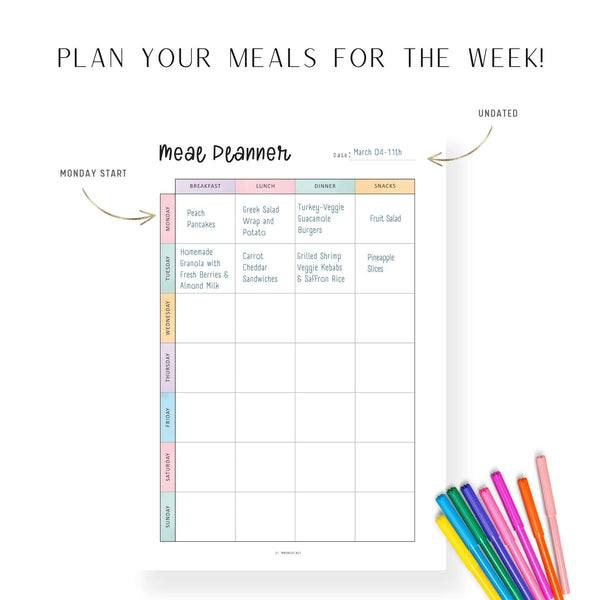

Cut down on dining out and cook meals at home #2

Cutting down on dining out and cooking meals at home can help you save money and eat healthier.

Here are some tips to help you make the switch:

Meal planning #1

Plan your meals for the week ahead of time.

This can help you make a grocery list and avoid the temptation to dine out when you don't have a plan.

Batch cooking #2

Cook in batches and store leftovers for future meals.

This can save you time during the week and reduce the urge to order takeout.

Stock up on essentials #3

Keep your pantry stocked with essential ingredients like grains, beans, spices, and canned goods.

This can make it easier to throw together a meal at home.

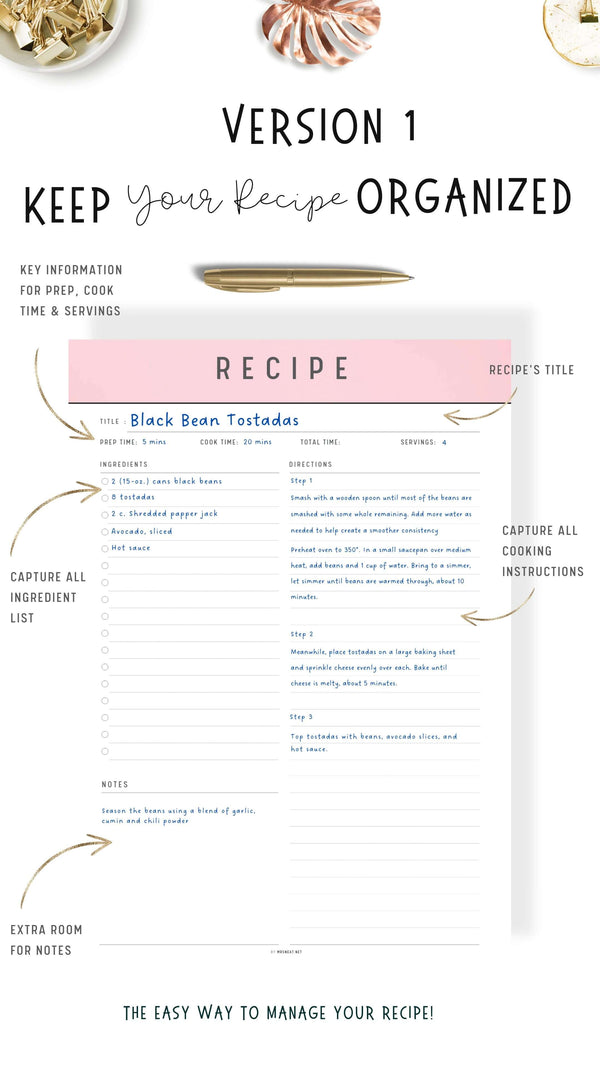

Cook simple recipes #4

You don't have to be a gourmet chef to cook at home.

Look for simple and quick recipes that require minimal ingredients and preparation time.

Use time-saving kitchen gadgets #5

Invest in tools like a slow cooker, Instant Pot, or air fryer to make cooking at home more convenient and time-efficient.

Limit dining out #6

Set a realistic goal for how often you want to dine out each week or month, and gradually reduce this number over time.

Prepare lunches #7

Bring your lunch to work instead of buying it.

You can save money and have more control over the ingredients in your meal.

Get creative with leftovers #8

Repurpose leftovers into new meals to prevent food waste and save time on cooking.

Track your savings #9

Keep a record of how much money you're saving by cooking at home instead of dining out.

This can serve as motivation to stick to your new habit.

Reward yourself #10

Treat yourself occasionally by dining out as a reward for sticking to your meal prep and cooking routine.

By implementing these tips and making cooking at home a habit, you can enjoy delicious, cost-effective meals while also improving your cooking skills and overall health.

Cancel unused subscriptions and memberships #3

Canceling unused subscriptions and memberships is a great way to save money and declutter your financial commitments.

Here's how you can go about canceling them:

Identify all subscriptions and memberships #1

Make a list of all the subscriptions and memberships you currently pay for. This may include streaming services, gym memberships, magazine subscriptions, etc.

Evaluate usage #2

Determine which subscriptions and memberships you actually use and which ones are no longer necessary or have become redundant.

Review cancellation policies #3

Check the cancellation policies for each subscription or membership.

Some may require you to cancel a certain number of days before your next billing cycle.

Cancel online #4

For many subscriptions, you can typically cancel online through your account settings on the service's website or app.

Look for a "Cancel Subscription" or "Membership Settings" option.

Contact customer service #5

If you can't cancel online or if you're having trouble, reach out to customer service for assistance.

They can guide you through the cancellation process.

Keep confirmation emails #6

After canceling, make sure to keep a record of the cancellation confirmation emails or numbers you receive as proof of cancellation.

Monitor your bank statements #7

Keep an eye on your bank or credit card statements to ensure that the subscriptions or memberships have been successfully canceled and are no longer being charged.

Consider alternatives #8

If you're canceling a subscrption because of cost, consider if there are cheaper alternatives or if you can live without that service altogether.

Set reminders #9

Regularly review your subscriptions and memberships to see if there are any new ones you can cancel or any old ones that need to be reevaluated.

Use budgeting planner #10

Consider using budgeting planner that can help you track your subscriptions and notify you of any upcoming payments.

By following these steps and taking the time to review and cancel unused subscriptions and memberships, you can free up extra money in your budget and simplify your financial commitments.

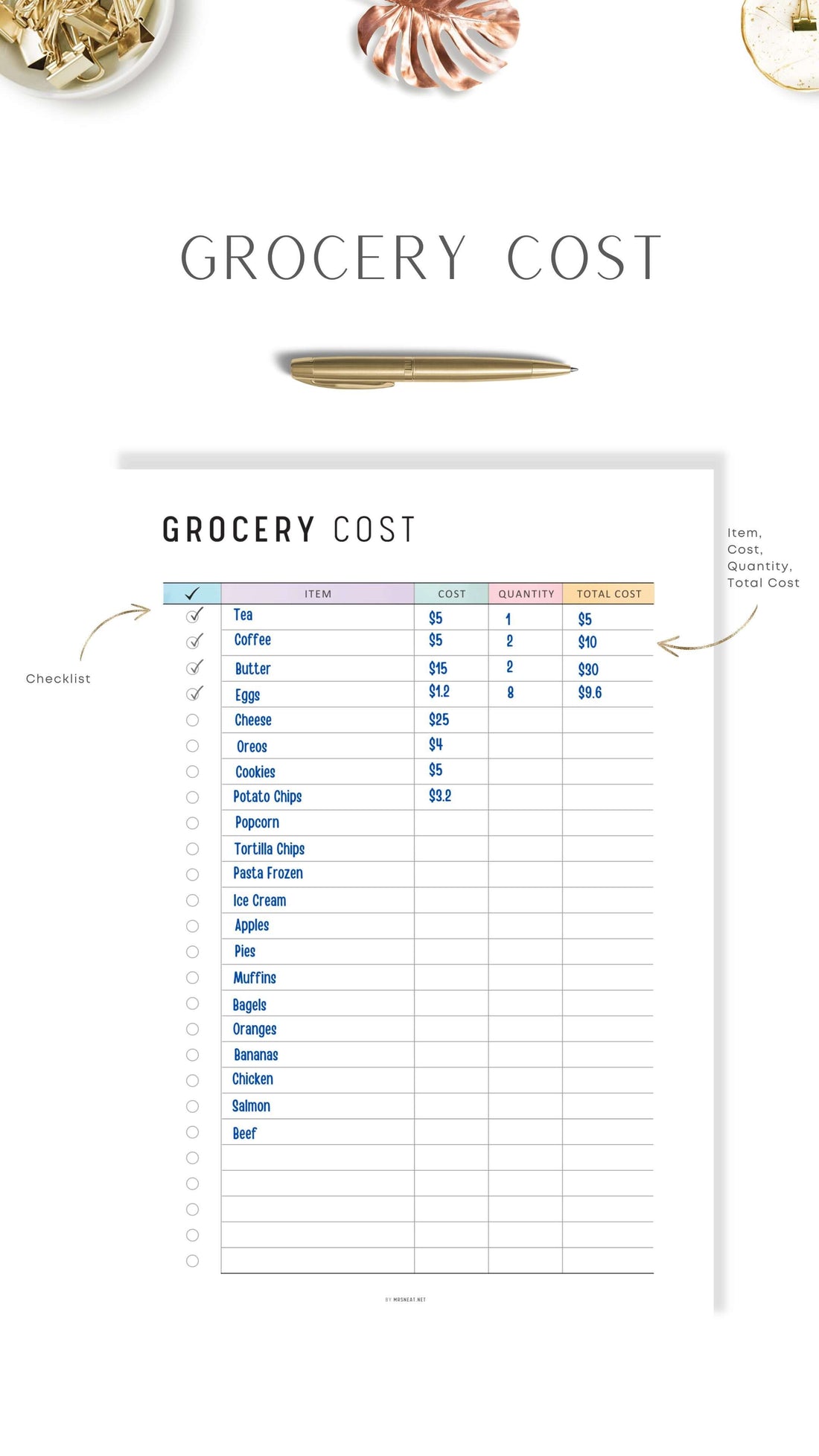

Limit impulse purchases by creating a shopping list #4

Limiting impulse purchases by creating a shopping list can help you stick to your budget and avoid buying things you don't need.

Here's how you can effectively create a shopping list to curb impulse buying:

Take inventory #1

Before making a shopping list, go through your pantry, fridge, and other spaces to see what you already have.

This will prevent you from buying duplicate items.

Plan meals #2

Base your shopping list on the meals you plan to cook for the week. Include ingredients you need for those specific recipes to avoid unnecessary purchases.

Set a budget #3

Determine how much you can afford to spend on groceries and other items.

This will help you prioritize purchases and avoid overspending.

Make a list #4

Write down the items you need on a physical list or use a shopping list app on your phone.

Organize the list by category (e.g., produce, dairy, pantry items) to make shopping more efficient.

Stick to the list #5

When you're at the store, resist the temptation to buy items not on your list.

Stay focused and only pick up the things you've planned to purchase.

Avoid shopping when hungry #6

Shopping on an empty stomach can lead to impulse purchases of unhealthy or unnecessary items.

Eat before you go shopping to stay on track.

Shop with a purpose #7

Have a clear objective in mind when you enter the store.

Focus on getting what you need and avoiding distractions that can lead to impulse buys.

Shop solo #8

If possible, shop alone to minimize outside influences that may encourage impulsive spending.

Avoid shopping with friends or family members who might sway your decisions.

Use cash #9

Consider using cash instead of cards for your shopping trips.

This can make you more aware of how much you're spending and discourage overspending.

Reflect on previous purchases #10

After each shopping trip, review your list and note any impulse buys you made.

Learn from these experiences to improve your list-making and shopping habits in the future.

By following these steps and being disciplined about sticking to your shopping list, you can reduce impulse purchases, save money, and make more intentional spending choices.

Use public transportation or carpool to save on gas #5

Using public transportation or carpooling are great ways to save on gas, reduce your carbon footprint, and potentially save money on commuting.

Here's how you can effectively use these methods:

Public Transportation

Plan your route #1

Research the public transportation options available in your area, including buses, trains, subways, or trams.

Find the routes that best suit your commute.

Check schedules #2

Familiarize yourself with the schedules and timings of public transportation to ensure you can plan your commute effectively.

Purchase passes #3

Consider buying weekly, monthly, or annual passes if you plan to use public transportation frequently.

These passes often offer discounts compared to single tickets.

Use transit apps #4

Utilize transportation apps that provide real-time updates on schedules, delays, and routes to help you navigate public transportation more efficiently.

Combine with walking or biking #5

To save even more on transportation costs, consider walking or biking to and from public transportation stops if they are within a reasonable distance.

Carpooling

Find carpool partners #1

Reach out to colleagues, neighbors, or friends to see if anyone else in your area has a similar commute.

You can also use online carpooling platforms to connect with potential carpool partners.

Establish a schedule #2

Set a consistent schedule for the carpool, including pick-up and drop-off times and locations.

Clear communication and punctuality are key to a successful carpool.

Share responsibilities #3

Decide how expenses like gas, tolls, and parking will be divided among carpool members.

Consider rotating drivers to share the load and ensure fairness.

Be flexible #4

Be open to accommodating each other's schedules and occasional changes in plans.

Flexibility and cooperation are essential for a smooth carpooling experience.

Enjoy the benefits #5

In addition to saving on gas, carpooling can help reduce traffic congestion, lower vehicle maintenance costs, and provide a more social and eco-friendly commuting experience.

By utilizing public transportation or carpooling, you can save money on gas, reduce your environmental impact, and potentially enjoy a more relaxed and cost-effective commute.

Negotiate lower interest rates on credit cards and loans #6

Negotiating lower interest rates on credit cards and loans can help you save money on interest payments over time.

Here are some steps you can take to potentially secure lower rates:

For Credit Cards

Know your current rates #1

Understand the interest rates you are currently paying on your credit cards.

This knowledge will provide a basis for negotiation.

Research competitive rates #2

Research current interest rates being offered by other credit card issuers.

Having this information can strengthen your negotiation position.

Call your credit card company #3

Contact your credit card issuer's customer service department and politely inquire about lowering your interest rate.

Be prepared to explain why you believe you deserve a lower rate, such as a good payment history or improved credit score.

Leverage your payment history #4

Highlight your consistent on-time payments and responsible credit card usage to demonstrate that you are a low-risk borrower deserving of a lower rate.

Negotiate with a supervisor #5

If the customer service representative cannot lower your rate, ask to speak with a supervisor who may have more authority to adjust your interest rate.

For Loans

Review your loan terms #1

Understand the terms of your loan, including the interest rate, repayment period, and any fees.

This information will be crucial during negotiation.

Check your credit report #2

Ensure that your credit report is accurate and up to date.

A good credit score can strengthen your position when negotiating lower interest rates on loans.

Shop around for rates #3

Research current interest rates for similar loans offered by other lenders.

Use this information to negotiate a better rate with your current lender.

Consider refinancing #4

If negotiating with your current lender is unsuccessful, explore the option of refinancing your loan with another lender offering more favorable terms.

Emphasize your creditworthiness #5

Highlight factors that make you a low-risk borrower, such as a stable income, low debt-to-income ratio, and positive payment history.

This can make a compelling case for lowering your interest rate.

Remember that not all lenders or credit card issuers may be willing to negotiate lower rates, but it's always worth inquiring.

Politeness, preparation, and persistence can go a long way in potentially securing lower interest rates on your credit cards and loans.

Shop in bulk for non-perishable items #7

Shopping in bulk for non-perishable items can be a cost-effective way to save money and ensure you have a well-stocked pantry.

Here are some tips for successfully shopping in bulk:

Make a list #1

Before you head to the store, create a list of the non-perishable items you frequently use and would like to buy in bulk.

This will help you stay organized and avoid unnecessary purchases.

Calculate quantities #2

Estimate how much of each item you use regularly to determine how much you need to buy in bulk.

Consider the shelf life of the products to avoid buying more than you can use before they expire.

Check unit prices #3

Compare the unit prices of bulk items with the regular sizes to ensure you're getting the best deal.

Sometimes, smaller packages on sale may actually be cheaper than buying in bulk.

Visit wholesale stores #4

Warehouse clubs or wholesale stores often offer bulk items at discounted prices.

Consider getting a membership if you shop for bulk items regularly.

Look for sales and discounts #5

Keep an eye out for sales, coupons, and promotions on bulk items.

Buying in bulk when items are on sale can lead to additional savings.

Consider storage space #6

Make sure you have adequate storage space at home for the bulk items you purchase.

Proper storage will help maintain the quality of the products.

Rotate stock #7

Practice the "first in, first out" rule when storing bulk items.

Use older items first to prevent them from expiring or going to waste.

Buy versatile items #8

Opt for non-perishable items that have a long shelf life and can be used in multiple recipes.

This will help you make the most of your bulk purchases.

Share with others #9

Consider splitting bulk purchases with friends or family members to share the cost and quantities of items that you may not need in large quantities.

Track savings #10

Keep track of how much you're saving by buying in bulk compared to purchasing individual items.

This can motivate you to continue shopping smartly.

By following these tips and being mindful of your purchasing habits, you can effectively shop in bulk for non-perishable items, save money in the long run, and ensure that your pantry is well-stocked with essentials.

Find free or low-cost entertainment options #8

Finding free or low-cost entertainment options can be a great way to have fun and socialize without breaking the bank.

Here are some ideas to help you discover affordable entertainment options:

Local events #1

Check out community bulletin boards, local newspapers, and social media for free or low-cost events happening in your area, such as festivals, concerts, art exhibitions, or outdoor movie nights.

Public parks #2

Visit nearby parks for activities like picnicking, hiking, biking, or simply enjoying the outdoors.

Many parks also host free events or concerts during certain times of the year.

Libraries #3

Explore your local library for a wide range of free entertainment options, such as borrowing books, movies, music, and participating in book clubs, storytelling sessions, or workshops.

Museums and galleries #4

Look for free admission days or discounted tickets at museums, art galleries, or cultural centers in your area.

Some institutions offer free entry during specific times or for special exhibits.

Volunteer at events #5

Consider volunteering at local events, festivals, or concerts in exchange for free admission or other perks.

It's a great way to support your community and enjoy entertainment for free.

Educational opportunities #6

Attend free or low-cost workshops, lectures, or classes hosted by community centers, universities, or organizations.

Learn something new while engaging in an entertaining activity.

Outdoor activities #7

Explore nature reserves, beaches, lakes, or hiking trails for outdoor recreation like swimming, picnicking, birdwatching, or stargazing.

Nature offers endless opportunities for free entertainment.

Movie nights at home #8

Host a movie night at home with friends or family, complete with homemade snacks and a film marathon.

Many streaming platforms also offer free trials or low-cost subscriptions for entertainment.

Online resources #9

Take advantage of online resources for free entertainment, such as podcasts, free e-books, virtual tours of museums, online courses, or live streaming of concerts and events.

Attend community events #10

Participate in community activities like farmers' markets, food festivals, street fairs, or holiday celebrations, which often offer free entertainment, live music, and local vendors.

By exploring these diverse options and being open to trying new activities, you can find plenty of free or low-cost entertainment opportunities that cater to your interests and help you have a great time without spending a fortune.

Reduce energy consumption by using energy-efficient appliances #9

Reducing energy consumption by using energy-efficient appliances is not only beneficial for the environment but can also help you save money on your utility bills.

Here are some tips on how to effectively utilize energy-efficient appliances:

Look for Energy Star ratings #1

When purchasing new appliances, check for the Energy Star label.

Energy Star appliances meet strict energy efficiency guidelines set by the EPA and can help you save on energy costs.

Upgrade to energy-efficient models #2

Consider replacing old, inefficient appliances with newer energy-efficient models.

Look for features like automatic shutoff, energy-saving modes, and smart technology that optimizes energy use.

Use appliances efficiently #3

Follow manufacturer recommendations for proper use and maintenance of appliances.

For example, running full loads in the dishwasher and washing machine can help conserve energy.

Set appropriate temperatures #4

Adjust the temperature settings on appliances like refrigerators, freezers, water heaters, and air conditioners to optimal levels.

Lowering water heater temperatures, for instance, can save energy.

Utilize programmable settings #5

Take advantage of programmable settings on appliances like thermostats, washing machines, and ovens to run them at specific times or temperatures for maximum efficiency.

Unplug when not in use #6

Unplug appliances that are not in use to prevent "phantom energy" consumption. Devices on standby mode can still draw power, contributing to energy waste.

Maintain appliances regularly #7

Keep appliances clean and well-maintained to ensure optimal performance.

This includes cleaning filters, coils, and vents, as well as scheduling professional maintenance when needed.

Use natural light #8

Take advantage of natural light during the day to reduce the need for artificial lighting.

Utilize curtains, shades, and window treatments to control light and heat levels.

Consider energy-saving light bulbs #9

Replace incandescent bulbs with energy-efficient LED or CFL bulbs.

These bulbs use less energy and last longer than traditional bulbs.

Monitor energy usage #10

Invest in energy-monitoring devices or smart plugs to track energy usage and identify areas where you can improve efficiency.

Being aware of your energy consumption can help you make informed decisions.

By incorporating these practices into your daily routines and making conscious choices about energy use, you can effectively reduce energy consumption and lower your utility bills while benefiting the environment.

Sell items you no longer need or use #10

Selling items you no longer need or use is a great way to declutter your space and make some extra money. Here are steps you can take to effectively sell your unwanted items:

Gather your items #1

Collect all the items you want to sell and set them aside in a designated area. This will help you stay organized throughout the selling process.

Assess the condition #2

Check the condition of each item you plan to sell.

Clean, repair, or refurbish items as needed to increase their appeal and value.

Research pricing #3

Research the market value of similar items to determine a fair selling price.

Online platforms and resale websites can give you an idea of how much to ask for your items.

Choose a selling platform #4

Decide where you want to sell your items.

Options include online marketplaces like eBay, Craigslist, Facebook Marketplace, or dedicated selling apps like Poshmark or Mercari.

Take quality photos #5

Capture clear, well-lit photos of your items from multiple angles.

High-quality images can attract more potential buyers and increase the chances of a sale.

Write detailed descriptions #6

Provide accurate and detailed descriptions of your items, including dimensions, brand, condition, and any relevant information that can help buyers make an informed decision.

Set up payment and delivery options #7

Decide how you want to handle payments and delivery.

Consider options like PayPal, Venmo, or in-person pickup to make the transaction smooth and secure.

Promote your listings #8

Share your listings on social media, forums, or with friends and family to reach a wider audience.

Effective promotion can help increase visibility and interest in your items.

Be responsive #9

Respond promptly to inquiries from potential buyers and be prepared to negotiate prices if needed.

Clear communication can lead to successful transactions.

Pack items securely #10

Once you've made a sale, pack items securely for shipping or arrange for safe pickup.

Providing a positive buying experience can lead to good reviews and repeat customers.

By following these steps and taking the time to showcase your items effectively, communicate with buyers professionally, and provide excellent customer service, you can successfully sell items you no longer need or use while earning some extra cash in the process.

DIY household repairs and maintenance #11

DIY household repairs and maintenance can help you save money and become more self-sufficient when it comes to taking care of your home.

Here are some tips to help you tackle common household repairs and maintenance tasks on your own:

Basic toolkit #1

Invest in a good set of basic tools such as a hammer, screwdrivers, pliers, a tape measure, a level, adjustable wrenches, and a utility knife.

Having the right tools is essential for DIY projects.

Educate yourself #2

Take advantage of online tutorials, DIY websites, books, and videos to learn how to perform various household repairs and maintenance tasks.

Understanding the process beforehand can help you tackle projects more effectively.

Start small #3

Begin with simple DIY projects like fixing leaky faucets, replacing light fixtures, painting walls, or patching small holes in drywall.

Gradually build your skills and confidence before moving on to more complex tasks.

Safety first #4

Prioritize safety while working on DIY projects.

Use protective gear like gloves, goggles, and masks when necessary, and follow safety guidelines when handling tools and materials.

Maintain regularly #5

Schedule routine maintenance tasks such as checking smoke detectors, changing air filters, inspecting for leaks, cleaning gutters, and servicing HVAC systems. Preventative maintenance can help you avoid costly repairs later on.

Ask for help #6

Don't hesitate to seek advice from knowledgeable friends, family members, or professionals if you encounter challenges during a DIY project. Sometimes a second opinion or expert guidance can make a big difference.

Take your time #7

Rushing through DIY projects can lead to mistakes or accidents.

Take your time to plan, measure, and execute tasks carefully to achieve quality results.

Budget wisely #8

Consider the costs of materials and tools before starting a DIY project. Create a budget and stick to it to avoid overspending.

You can also look for budget-friendly alternatives or repurpose materials to save money.

Document your work #9

Keep a record of the repairs and maintenance tasks you perform, including the dates, materials used, and any challenges encountered.

This documentation can be helpful for future reference or when selling your home.

Don't be afraid to experiment #10

DIY projects are a great opportunity to learn new skills and test your creativity.

Embrace the challenge and be open to trying new techniques to improve your home.

By following these tips and approaching DIY projects with patience, preparation, and a willingness to learn, you can effectively handle household repairs and maintenance tasks on your own, saving money and gaining a sense of accomplishment along the way.

Buy generic brands instead of name brands #12

To buy generic brands instead of name brands, you can follow these steps:

Compare Prices #1

Look at the price difference between the generic and name brand products.

Often, generic brands are more cost-effective.

Check Ingredients #2

Compare the ingredient list of the generic and name brand products.

They are often very similar, if not identical.

Read Reviews #3

Check online reviews to see what others think of the generic brand.

This can help you gauge the quality and performance.

Try it Out #4

Start with buying a small quantity of the generic brand to test out the product for yourself.

Look for Sales and Discounts #5

Sometimes generic brands go on sale, making them an even better deal compared to name brands.

By following these steps, you can save money without compromising on quality when buying generic brands.

Conclusion

In conclusion, saving $1000 or more each month is achievable with practical changes to your habits and expenses.

By implementing strategies such as creating a budget, tracking spending, reducing unnecessary expenses, limiting dining out, negotiating bills, cutting transportation costs, shopping secondhand, avoiding impulse buys, increasing income, lowering utility costs, and automating savings, you can make significant progress towards reaching your savings goals.

Consistency, discipline, and a commitment to mindful financial decisions are essential for successfully building your savings and securing your financial future.

By making small adjustments to your lifestyle and prioritizing savings, you can pave the way for long-term financial stability and achieve your financial objectives.

https://www.linkedin.com/in/mariswari/

https://www.linkedin.com/in/mariswari/