Master Your Money: 10 Reasons to Use an Income and Expense Tracker Printable

maris wariShare

Managing your finances effectively is essential for achieving your financial goals and maintaining financial stability.

One of the most effective tools for managing your finances is an income and expense tracker printable.

Here are 10 reasons why you should use an income and expense tracker printable

Budgeting #1

An income and expense tracker printable helps you create and stick to a budget.

By tracking your income and expenses, you can see where your money is going and identify areas where you can cut back or make changes.

Here's a detailed step-by-step guide to using an income and expense tracker printable for budgeting:

Step 1: Download or Create Your Tracker

Start by downloading an income and expense tracker printable from a reliable source. You can find various design of income and expense tracker in here.

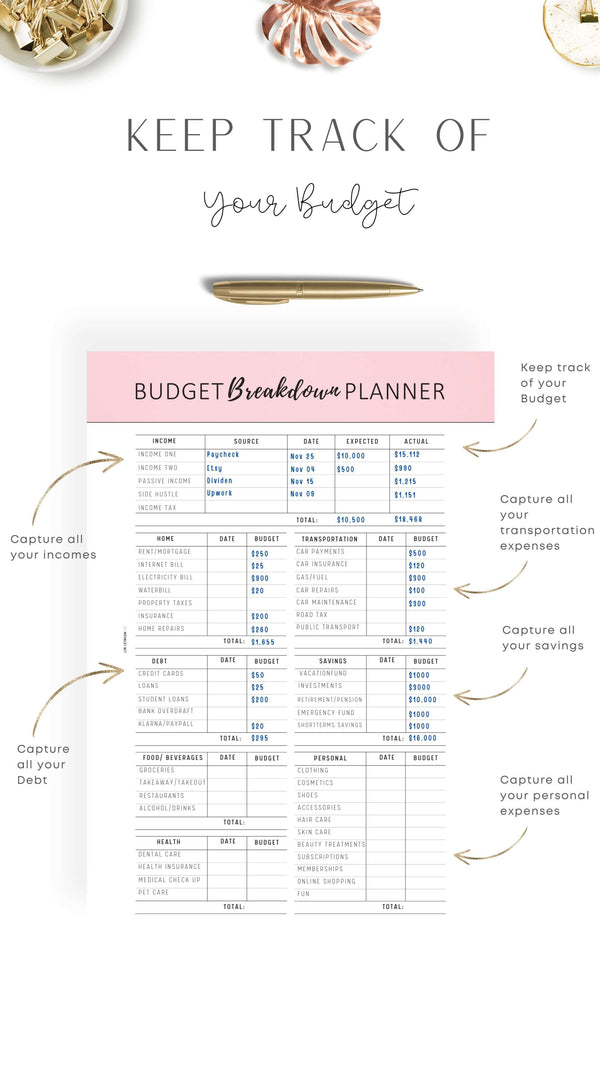

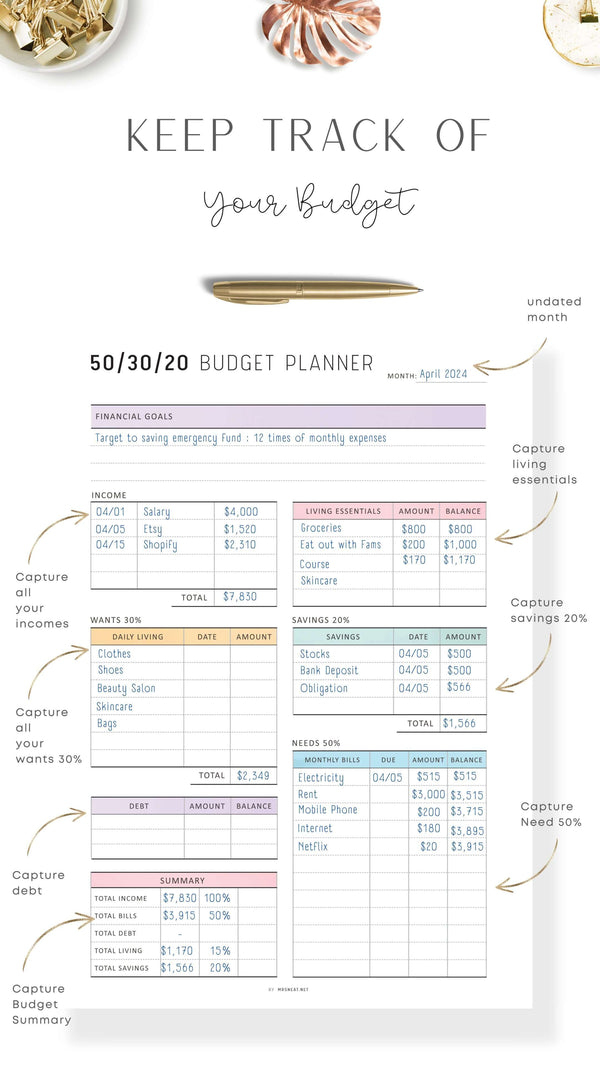

Make sure your tracker includes spaces for the date, income sources, expense categories, and any other relevant information - like this one.

Step 2: Set Up Your Tracker

Set up your tracker by entering your income sources and expense categories. This will help you organize your finances and make it easier to track your spending.

You can include categories like rent/mortgage, utilities, groceries, transportation, entertainment, and any other expenses you may have.

Step 3: Enter Your Income

Begin by entering your income sources into your tracker. This can include your salary, any additional income you may have, and any other sources of income.

Be sure to include the date, the amount, and the category (income) for each transaction.

Step 4: Enter Your Expenses

Next, enter your expenses into your tracker. This can include rent or mortgage payments, utilities, groceries, transportation, entertainment, and any other expenses you may have.

Be sure to include the date, the amount, and the category (expense) for each transaction.

Step 5: Record Your Transactions

As you make purchases or receive income, record the transactions in your tracker. Be sure to include the date, the amount, and the category (income or expense) for each transaction.

Step 6: Categorize Your Expenses

Categorize your expenses into different categories, such as housing, transportation, groceries, and entertainment.

This will help you see where your money is going and identify areas where you can cut back.

Step 7: Track Your Spending

Keep track of your spending throughout the month by recording each transaction in your tracker.

This will help you stay on top of your finances and avoid overspending.

Step 8: Review Your Tracker

At the end of each month, review your tracker to see where your money is going and how you're doing compared to your budget.

This will help you make any necessary adjustments to your spending and stay on track with your financial goals.

Step 9: Make Adjustments

If you find that you're overspending in certain categories, look for ways to cut back.

This might involve reducing your discretionary spending, finding ways to save on your fixed expenses, or finding ways to increase your income.

Remember to regularly review and update your goals as your financial situation changes

Financial Goals #2

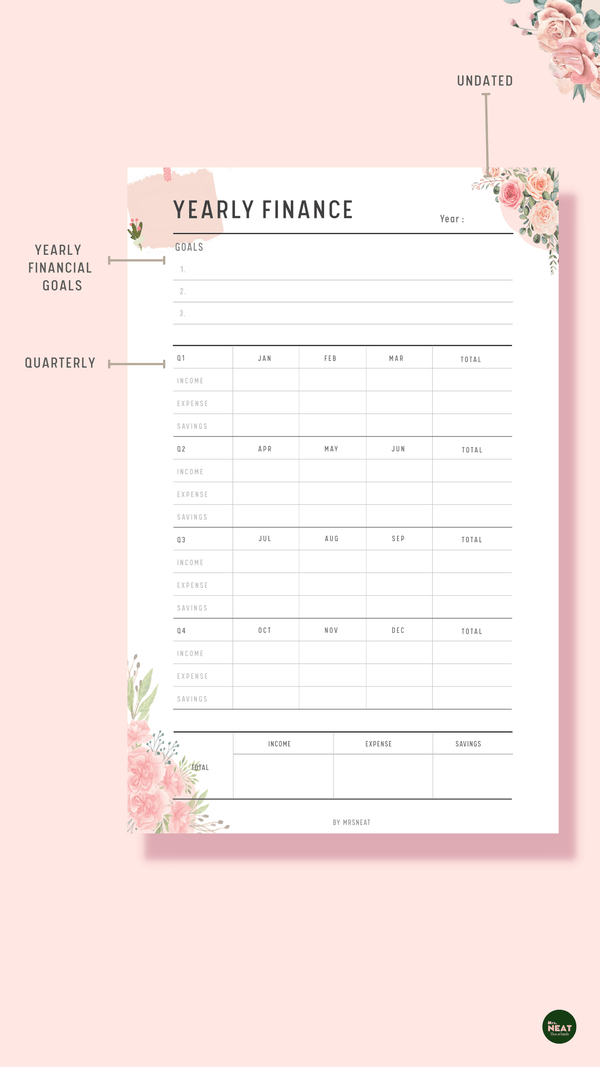

An income and expense tracker printable allows you to set and can be an effective tool to help you achieve your financial goals.

Before you start tracking your income and expenses, it's important to set specific, measurable, and realistic financial goals.

Setting financial goals is an important step towards achieving financial success.

These could include saving for a down payment on a house, paying off debt, or building an emergency fund you can use your tracker to monitor your progress and stay on track.

Here's a step-by-step guide to help you set your financial goals:

Assess Your Current Financial Situation

Before setting your financial goals, it's important to assess your current financial situation.

This includes understanding your income, expenses, assets, and liabilities.

Identify Your Short-Term, Medium-Term, and Long-Term Goals

Financial goals can be categorized into short-term (1-3 years), medium-term (3-5 years), and long-term (5+ years) goals.

Identify what you want to achieve in each of these timeframes.

Make Your Goals SMART

Ensure that your financial goals are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART).

For example, instead of saying "I want to save money," you could say "I want to save $5,000 in the next 12 months by saving $417 per month."

Prioritize Your Goals

Once you've identified your financial goals, prioritize them based on their importance and urgency.

This will help you focus on the goals that are most important to you.

Break Down Your Goals

Break down your financial goals into smaller, manageable steps. This will make it easier to track your progress and stay motivated.

Set a Timeline

Assign a timeline to each of your financial goals.

This will help you stay on track and ensure that you achieve your goals within a reasonable timeframe.

Monitor Your Progress

Regularly monitor your progress towards your financial goals.

This will help you stay motivated and make any necessary adjustments to your plan.

Celebrate Your Achievements

Once you achieve a financial goal, take the time to celebrate your achievement.

This will help you stay motivated and inspired to continue working towards your other goals.

By following these steps, you can set meaningful and achievable financial goals that will help you achieve financial success.

Remember to review your tracker regularly, make any necessary adjustments to your spending, and stay focused on your goals.

With a little effort and discipline, you can achieve financial success and build a secure future for yourself and your family.

Debt Management #3

If you have debt, an income and expense tracker printable can help you manage it more effectively.

You can track your debt payments and see how much progress you're making toward paying off your Debt.

Using an income and expense tracker printable for debt management can be an effective way to track your progress, make informed decisions, and ultimately pay off your debt faster.

Here's how you can use an income and expense tracker printable for debt management:

Download or Create Your Tracker

Start by downloading an income and expense tracker printable which debt payment tracker included - like this one.

Set Up Your Tracker

Set up your tracker by entering your income sources and expense categories.

Include categories such as rent/mortgage, utilities, groceries, transportation, entertainment, and any other expenses you may have.

Enter Your Income

Enter your income sources into your tracker. Include your salary, any additional income you may have, and any other sources of income.

Enter Your Expenses

Enter your expenses into your tracker. Include rent or mortgage payments, utilities, groceries, transportation, entertainment, and any other expenses you may have.

Record Your Transactions

Record your transactions in your tracker as you make purchases or receive income.

Include the date, amount, and category (income or expense) for each transaction.

Categorize Your Expenses

Categorize your expenses into different categories, such as housing, transportation, groceries, and entertainment.

This will help you see where your money is going and identify areas where you can cut back.

Track Your Spending

Keep track of your spending throughout the month by recording each transaction in your tracker.

This will help you stay on top of your finances and avoid overspending.

Calculate Your Debt Payments

Calculate your debt payments and enter them into your tracker.

This will help you see how much progress you're making toward paying off your debt.

Review Your Tracker

At the end of each month, review your tracker to see where your money is going and how you're doing compared to your budget.

Make any necessary adjustments to your spending and debt payments.

Make Adjustments

If you find that you're overspending in certain categories, look for ways to cut back.

This might involve reducing your discretionary spending, finding ways to save on your fixed expenses, or finding ways to increase your income.

By using an income and expense tracker printable for debt management, you can take control of your finances, track your progress, and ultimately pay off your debt faster.

Remember to review your tracker regularly, make any necessary adjustments to your spending and debt payments, and stay focused on your goals.

With a little effort and discipline, you can achieve financial success and build a secure future for yourself and your family.

Related Articles;

- The Ultimate Financial Planner Bundle: Essential Tools for Mastering Your Finances

- Master Your Finances with Our Monthly Budget Planner

- How Budget Planner save My Financial Life

Increased Awareness #4

An income and expense tracker printable increases your awareness of your financial situation.

By recording your income and expenses, you can see where your money is going and identify areas where you can cut back or make changes.

Using an income and expense tracker printable can significantly increase your financial awareness in several ways:

Seeing the Big Picture

When you have all your income and expenses laid out in front of you, it's easier to see your financial situation as a whole.

This can be a powerful way to understand where your money is going and identify areas where you might be overspending or not allocating enough resources.

Identifying Patterns

Tracking your income and expenses over time allows you to identify patterns and trends in your spending habits.

For example, you might notice that you consistently spend more on dining out during certain months, which can help you make more informed decisions about your spending.

Budgeting Effectively

By having a clear picture of your income and expenses, you can create a more realistic and effective budget.

This can help you allocate your resources more effectively and avoid overspending.

Setting Financial Goals

An income and expense tracker printable can also help you set and achieve financial goals.

For example, if you want to save for a vacation, you can use your tracker to see how much you need to save each month to reach your goal.

Monitoring Progress

Once you've set your financial goals, you can use your tracker to monitor your progress. This can help you stay motivated and on track with your goals.

Making Informed Decisions

By having a clear understanding of your income and expenses, you can make more informed decisions about your money.

For example, if you're considering a major purchase, you can use your tracker to see how it will impact your budget.

Avoiding Financial Surprises

Finally, an income and expense tracker printable can help you avoid financial surprises.

By staying on top of your income and expenses, you can identify potential issues before they become major problems.

Overall, an income and expense tracker printable can be a powerful tool for increasing your financial awareness.

By tracking your income and expenses, you can gain a better understanding of your financial situation, identify patterns and trends, create a more effective budget, set and monitor financial goals, make more informed decisions about your money, and avoid financial surprises.

Peace of Mind #5

Finally, an income and expense tracker printable can give you peace of mind knowing that you're in control of your finances.

By staying on top of your income and expenses, you can avoid financial surprises and make informed decisions about your money.

Goal Setting

Tracking your income and expenses can help you set and achieve financial goals.

Whether it's saving for a vacation or paying off debt, having a clear plan can bring peace of mind.

Reduced Stress

Financial stress is a common source of anxiety.

By keeping track of your finances, you can avoid unpleasant surprises and be more prepared for unexpected expenses.

Financial Security

Understanding your financial situation can give you a sense of security and confidence.

It can reassure you that you're on the right track and prepared for the future.

Improved Decision Making

A tracker helps you make better financial decisions.

Whether it's deciding on a major purchase or evaluating your spending habits, having accurate data can lead to more informed choices.

Emergency Preparedness

By budgeting and saving, you can build an emergency fund.

Knowing you have a financial safety net can provide peace of mind during uncertain times.

Overall, using an income and expense tracker can provide peace of mind by increasing financial awareness, helping with budgeting and goal setting, reducing stress, improving decision making, managing debt, and preparing for emergencies.

Tracking Spending #6

An income and expense tracker printable allows you to track your spending and identify areas where you can cut back.

Whether you're trying to save money or reduce your expenses, a tracker can help you achieve your financial goals.

Savings #7

An income and expense tracker printable helps you monitor your savings and stay on track with your savings goals.

Whether you're saving for a specific purchase or just trying to build up your savings, a tracker can help you achieve your goals.

Expense Analysis #8

An income and expense tracker printable allows you to analyze your expenses and make informed decisions about your money.

Whether you're trying to save money or reduce your expenses, a tracker can help you achieve your financial goals.

Expense analysis using an income and expense tracker printable involves reviewing your spending habits, identifying areas of overspending or underspending, and making informed decisions about your finances.

Here's how you can conduct an expense analysis using your tracker:

Review Your ExpensesStart by reviewing your expenses for the past month or quarter.

Look at each expense category and the amount spent in each category.

Identify Trends

Look for trends in your spending habits.

Are there certain categories where you consistently spend more than you budgeted? Are there categories where you consistently underspend?

Compare to Budget

Compare your actual expenses to your budgeted expenses.

Are you staying within your budget, or are you consistently overspending?

Identify Areas to Cut Back

Based on your analysis, identify areas where you can cut back on spending.

This might involve reducing your discretionary spending, finding ways to save on your fixed expenses, or finding ways to increase your income.

Set Goals

Use your analysis to set financial goals for yourself.

For example, if you're consistently overspending in the dining out category, you might set a goal to reduce your dining out expenses by a certain percentage each month.

Monitor Your Progress

Monitor your progress towards your goals by reviewing your tracker regularly.

This will help you stay on track and make any necessary adjustments to your spending.

Make Adjustments

If you find that you're overspending in certain categories, make adjustments to your budget.

This might involve reallocating funds from other categories or finding ways to increase your income.

Celebrate Your Achievements

Once you achieve a financial goal, take the time to celebrate your achievement.

This will help you stay motivated and inspired to continue working towards your other goals.

By conducting an expense analysis using your income and expense tracker printable, you can gain a better understanding of your spending habits, identify areas where you can cut back, set financial goals, and monitor your progress.

Remember to review your tracker regularly, make any necessary adjustments to your spending, and stay focused on your goals.

With a little effort and discipline, you can achieve financial success and build a secure future for yourself and your family.

Avoiding Financial Surprises #9

An income and expense tracker printable helps you avoid financial surprises by staying on top of your income and expenses.

Whether you're trying to save money or reduce your expenses, a tracker can help you achieve your financial goals.

By using an income and expense tracker printable, you can avoid financial surprises and take control of your finances.

Remember to review your tracker regularly, make any necessary adjustments to your spending, and stay focused on your goals.

With a little effort and discipline, you can achieve financial success and build a secure future for yourself and your family.

Financial Planning #10

Finally, an income and expense tracker printable helps you plan for your financial future.

Whether you're trying to save money or reduce your expenses, a tracker can help you achieve your financial goals.

By using an income and expense tracker printable, you can create a budget, set financial goals, monitor your progress, and make any necessary adjustments to your spending.

This can help you take control of your finances and achieve your financial goals.

Remember to review your tracker regularly, make any necessary adjustments to your spending, and stay focused on your goals.

With a little effort and discipline, you can achieve financial success and build a secure future for yourself and your family.

Overall, an income and expense tracker printable is a valuable tool for managing your finances effectively.

Whether you're trying to save money or reduce your expenses, a tracker can help you achieve your financial goals.

https://www.linkedin.com/in/mariswari/

https://www.linkedin.com/in/mariswari/