Why Every Household Needs a Budget Planner for Better Financial Health

maris wariShare

Maintaining good financial health is essential for achieving a stable and prosperous life. It involves managing your money wisely, ensuring you can meet your current needs, plan for the future, and handle any unexpected expenses.

Good financial health can reduce stress, provide a sense of security, and open up opportunities for growth and enjoyment. Yet, many households struggle with managing their finances, often due to a lack of structured planning and oversight.

This is where a budget planner becomes an invaluable tool.

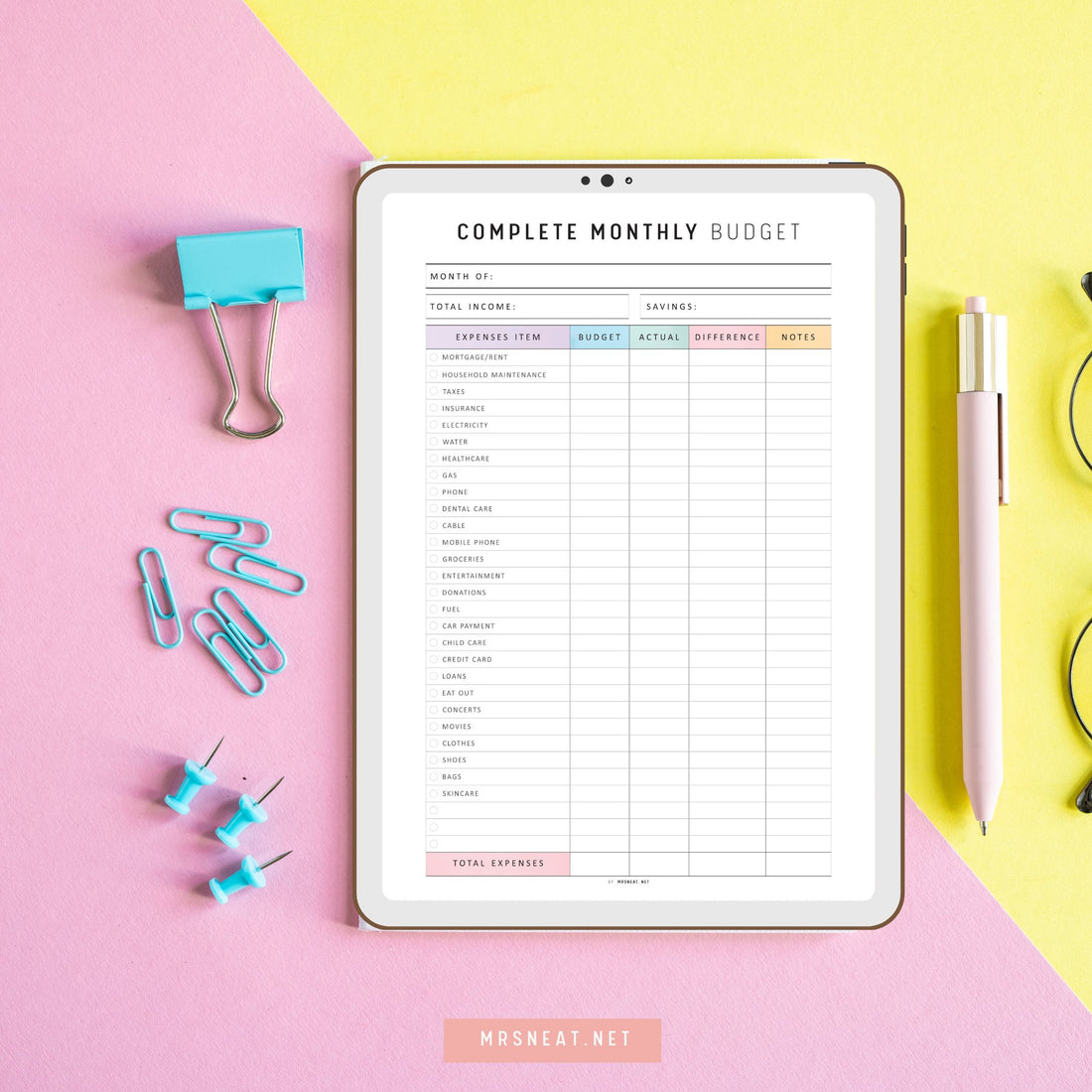

A budget planner is a systematic way to track your income, expenses, savings, and financial goals.

It can be a digital tool, a physical notebook, or a combination of both, designed to help you keep a close eye on your financial activities.

By using a budget planner, you can categorize your spending, set limits, and identify areas where you can cut back or save more.

It provides a clear and organized picture of your finances, making it easier to make informed decisions and stay on top of your financial situation.

The purpose of this blog is to highlight why every household should use a budget planner.

We will delve into the numerous benefits that come with budget planning, from improved financial awareness and control to stress reduction and goal achievement.

By the end of this blog, you'll understand the critical role a budget planner plays in enhancing financial health and be motivated to incorporate one into your daily life.

Whether you're looking to get out of debt, save for a big purchase, or simply manage your money more effectively, a budget planner can be the key to achieving your financial goals.

What is a Budget Planner?

A budget planner is a tool designed to help individuals and households manage their finances effectively.

At its core, a budget planner is a systematic way to track your income, expenses, savings, and financial goals.

It provides a comprehensive overview of where your money is coming from and how it is being spent, enabling you to make informed financial decisions.

By organizing your financial information in one place, a budget planner allows you to monitor your spending habits, identify areas for improvement, and plan for future expenses.

There are various types of budget planners available, catering to different preferences and needs.

Digital budget planners, such as apps and software programs, offer the convenience of automated calculations, easy updates, and accessibility from multiple devices.

Popular digital tools include Mint, YNAB (You Need A Budget), and various spreadsheet templates.

These tools often come with additional features like bill reminders, financial goal tracking, and spending alerts.

On the other hand, paper budget planners, including notebooks and printable templates, provide a tactile and customizable approach to budgeting.

They can be as simple as a ledger book or as detailed as a planner with sections for daily, weekly, and monthly tracking.

Budget planners can also vary based on the time frame they cover. Monthly budget planners focus on short-term financial management, allowing you to monitor your income and expenses on a month-by-month basis.

These are particularly useful for managing recurring bills, tracking variable expenses, and adjusting your spending habits regularly. Annual budget planners, in contrast, provide a broader perspective on your financial situation.

They help you plan for long-term goals, such as vacations, large purchases, or significant life events, by breaking down yearly financial targets into manageable monthly or quarterly segments.

Using a budget planner involves a few straightforward steps. First, you gather all your financial information, including income sources, fixed and variable expenses, savings, and any outstanding debts.

Next, you input this data into your chosen budget planner, categorizing expenses to see where your money is going. The planner then helps you set limits for each category based on your financial goals and priorities.

Regularly updating your budget planner with new transactions and reviewing it frequently allows you to stay on track, make adjustments as needed, and ensure that you are meeting your financial objectives.

By providing structure and clarity, a budget planner empowers you to take control of your finances and work towards a more secure and prosperous future.

Benefits of Using a Budget Planner

Improved Financial Awareness

Using a budget planner significantly enhances your financial awareness by providing a clear and detailed view of your income and expenses.

By diligently tracking every source of income and all your expenditures, you become more mindful of your financial habits. This awareness is crucial for making informed decisions about your money.

A budget planner allows you to categorize expenses, making it easier to identify where your money is going. Over time, you can spot spending patterns that might otherwise go unnoticed.

For example, you might realize that you're spending more on dining out than you intended, prompting you to make adjustments that align with your financial goals.

Better Financial Control

A budget planner empowers you with better financial control by helping you set and stick to a budget.

By establishing spending limits for various categories, such as groceries, entertainment, and transportation, you can manage your money more effectively and avoid overspending.

This proactive approach to budgeting helps prevent debt accumulation and ensures that you live within your means.

With a budget planner, you can make deliberate choices about your expenditures, prioritize essential expenses, and allocate funds toward savings or debt repayment.

This level of control is vital for maintaining financial stability and achieving long-term financial health.

Goal Setting and Achievement

One of the most significant benefits of using a budget planner is its role in setting and achieving financial goals.

Whether you're aiming to save for a down payment on a house, pay off student loans, or build an emergency fund, a budget planner helps you outline clear short-term and long-term goals.

By breaking down these goals into manageable steps and tracking your progress regularly, you stay motivated and focused.

The visual representation of your progress, such as seeing your savings grow or your debt decrease, reinforces your commitment and provides a sense of accomplishment, making your financial goals more attainable.

Stress Reduction

Financial stress can have a considerable impact on your overall well-being, but a budget planner can significantly reduce this anxiety.

Having a clear financial plan in place gives you peace of mind, as you know exactly where your money is going and what you need to do to achieve your financial goals.

By using a budget planner, you can anticipate and prepare for upcoming expenses, avoid financial surprises, and ensure that you are on track to meet your obligations.

This sense of control and preparedness reduces the uncertainty and worry associated with financial management, leading to a more relaxed and confident approach to your finances.

In summary, a budget planner is an essential tool for anyone looking to improve their financial health.

It enhances financial awareness, provides better control over your money, aids in setting and achieving goals, and reduces financial stress.

By incorporating a budget planner into your routine, you can take proactive steps towards a more secure and prosperous financial future.

How to Start Using a Budget Planner

Choosing the Right Type of Budget Planner for Your Needs

The first step in starting to use a budget planner is selecting the one that best suits your needs and preferences. Consider whether you prefer a digital or paper budget planner.

Digital budget planners, such as apps and spreadsheet templates, offer convenience and automatic calculations, making them ideal for those who want easy access and real-time updates.

Popular digital tools include Mint, YNAB (You Need A Budget), and Google Sheets.

On the other hand, paper budget planners, like notebooks and printed templates, provide a tactile experience and can be customized more freely, which some people find more engaging and motivating.

Additionally, think about whether you need a monthly, quarterly, or annual planner based on your financial planning horizon.

Gathering Financial Information

Before setting up your budget planner, gather all the necessary financial information to get an accurate picture of your current financial situation.

Start by listing all sources of income, including salaries, freelance work, investments, and any other earnings.

Next, compile a detailed list of your expenses, breaking them down into fixed expenses (such as rent, utilities, and insurance) and variable expenses (like groceries, entertainment, and dining out).

Don’t forget to include irregular expenses that occur periodically, such as car maintenance or annual subscriptions.

Additionally, note any debts you owe, including credit cards, student loans, and personal loans, as well as your current savings and investment accounts.

Setting Up Your Budget

Once you have all your financial information, it’s time to set up your budget. Start by categorizing your expenses to better understand where your money goes each month.

Common categories include housing, utilities, transportation, groceries, dining, entertainment, healthcare, savings, and debt repayment.

After categorizing, set realistic spending limits for each category based on your income and financial goals. It’s important to ensure that your total expenses do not exceed your income.

If they do, identify areas where you can cut back. Allocate funds for savings and debt repayment as part of your budget. Remember, the goal is to create a balanced budget that supports your financial well-being and goals.

Regularly Updating and Reviewing Your Budget

A budget is a dynamic tool that requires regular updating and reviewing to remain effective. Make it a habit to update your budget planner with new transactions, such as income received and expenses paid, on a regular basis.

This could be daily, weekly, or monthly, depending on what works best for you. Regular updates help you stay on track and avoid overspending.

Additionally, review your budget periodically to assess your progress toward your financial goals and make any necessary adjustments.

Life circumstances and financial situations can change, so it’s crucial to adapt your budget accordingly. This ongoing review process ensures that your budget remains relevant and effective in helping you achieve your financial objectives.

By following these steps—choosing the right budget planner, gathering your financial information, setting up your budget, and regularly updating and reviewing it—you’ll be well on your way to taking control of your finances and improving your financial health.

A budget planner not only helps you manage your money better but also empowers you to make informed financial decisions and work towards a more secure and prosperous future.

Tips for Effective Budget Planning

Be Realistic

One of the most important tips for effective budget planning is to be realistic about your financial goals and expectations. Setting achievable financial goals ensures that you are more likely to stay motivated and committed to your budget.

For instance, while it’s admirable to aim to save a large sum of money quickly, setting a more attainable monthly savings target might be more practical.

Assess your current financial situation honestly and set goals that are challenging yet achievable.

This approach helps you maintain a balance between living your life and working towards your financial objectives without feeling overwhelmed or discouraged.

Consistency is Key

Consistency plays a crucial role in effective budget planning. Regularly updating and sticking to your budget planner helps you maintain control over your finances and ensures that you are continuously working towards your goals.

Make it a habit to log your income and expenses promptly, and review your budget periodically. This consistent tracking allows you to identify any discrepancies early and adjust your spending accordingly.

It also helps build a routine that integrates financial planning into your daily life, making it easier to stick to your budget in the long run.

Review and Adjust

A budget is not a static document; it needs to be reviewed and adjusted periodically to reflect changes in your financial situation.

Whether you receive a salary increase, incur unexpected expenses, or your financial goals evolve, it’s essential to revisit your budget regularly.

Periodically reviewing your budget helps you stay on top of your finances and make necessary adjustments to stay aligned with your goals.

For example, if you notice that your utility bills are consistently higher than expected, you can adjust other categories to accommodate this expense or find ways to reduce your utility usage.

Flexibility in your budget ensures it remains relevant and effective.

Involve the Whole Household

Effective budget planning involves the participation of all household members. Encouraging everyone in the family to take part in budgeting discussions and decisions fosters a sense of shared responsibility and cooperation.

When everyone is aware of the financial goals and constraints, it becomes easier to work together to achieve them. Hold regular family meetings to discuss the budget, review progress, and make adjustments as needed.

This collaborative approach not only helps in achieving financial goals but also teaches valuable financial management skills to all family members, fostering a culture of financial responsibility within the household.

By implementing these tips—being realistic, maintaining consistency, reviewing and adjusting regularly, and involving the whole household—you can enhance the effectiveness of your budget planning.

These practices help you stay focused on your financial goals, adapt to changing circumstances, and ensure that everyone is on the same page, making the journey to financial health smoother and more manageable.

Overcoming Common Budgeting Challenges

Addressing Common Obstacles: Irregular Income and Unexpected Expenses

Budgeting can be particularly challenging for those with irregular income or unexpected expenses.

Irregular income, common among freelancers, contractors, and commission-based workers, makes it difficult to predict monthly earnings.

To manage this, base your budget on your lowest monthly income, ensuring that your essential expenses are covered even during lean months.

Save any excess income in higher-earning months to create a buffer for lower-earning periods.

Unexpected expenses, such as medical bills or car repairs, can also disrupt your budget. To mitigate this, establish an emergency fund that you regularly contribute to, ensuring you have a financial cushion for unforeseen costs.

Additionally, categorize your expenses into fixed (necessities) and variable (non-essentials) to identify areas where you can cut back if needed. This strategy helps you remain financially stable even when surprises arise.

Tips for Staying Motivated and Disciplined

Staying motivated and disciplined is crucial for successful budgeting, but it can be challenging over time. One effective strategy is to set clear, achievable financial goals that inspire you to stick to your budget.

Whether it's saving for a vacation, paying off debt, or building an emergency fund, having a tangible goal provides a sense of purpose. Celebrate small milestones along the way to maintain your motivation and acknowledge your progress.

Another tip is to create a visual representation of your financial goals, such as a savings thermometer or debt payoff chart, and place it somewhere visible. This constant reminder keeps your goals top of mind.

Additionally, automate your savings and bill payments to reduce the temptation to spend money impulsively.

Automation ensures that you prioritize your financial goals and avoid missed payments, helping you stay on track without having to rely solely on willpower.

When facing budgeting challenges, seeking additional support and advice can make a significant difference. Numerous resources are available to help you navigate financial obstacles and enhance your budgeting skills.

Financial literacy websites and blogs, such as NerdWallet and The Balance, offer practical tips and tools for managing your finances.

These platforms often provide budget templates, calculators, and step-by-step guides to help you create and maintain an effective budget.

Financial advisors and coaches can also offer personalized advice and strategies tailored to your specific situation. They can help you develop a comprehensive financial plan, address complex issues, and provide ongoing support.

Additionally, consider joining online forums and communities where you can share experiences, seek advice, and gain encouragement from others who are on similar financial journeys.

Engaging with a supportive community can boost your motivation and provide valuable insights into overcoming budgeting challenges.

By addressing common obstacles such as irregular income and unexpected expenses, implementing strategies to stay motivated and disciplined, and utilizing available resources for support and advice, you can overcome the common challenges of budgeting.

These approaches empower you to take control of your finances, stay committed to your goals, and build a solid foundation for long-term financial success.

Conclusion

Throughout this blog, we have explored the significant benefits of using a budget planner to enhance financial health. We began by defining what a budget planner is and the different types available, from digital tools to paper planners.

We discussed how to start using a budget planner by choosing the right type, gathering financial information, setting up your budget, and regularly updating and reviewing it.

Additionally, we provided tips for effective budget planning, such as setting realistic goals, maintaining consistency, periodically reviewing and adjusting your budget, and involving the whole household.

We also addressed common budgeting challenges and offered strategies for overcoming obstacles like irregular income and unexpected expenses, staying motivated, and seeking additional support and advice.

Using a budget planner is a crucial step towards achieving better financial health.

It offers improved financial awareness by tracking your income and expenses, better financial control by setting and sticking to a budget, and the ability to set and achieve financial goals.

A budget planner also reduces financial stress by providing a clear financial plan.

By incorporating these practices into your routine, you can gain control over your finances, make informed decisions, and work towards a secure and prosperous future.

Now is the perfect time to take control of your finances by starting to use a budget planner.

Whether you opt for a digital tool or a paper planner, the key is to begin tracking your income and expenses, setting realistic goals, and regularly reviewing your progress.

By doing so, you will be well on your way to achieving financial stability and peace of mind.

To help you get started, here are some recommended budget planners:

Digital Budget Planners:

- Mint

- YNAB (You Need A Budget)

- Google Sheets Budget Templates

Paper Budget Planners:

- 50/30/20 Budget Template Printable

- Budget Sheet Printable Planner

- Paycheck Budget Template Printable

- Articles and Guides on Financial Planning and Budgeting

For further reading and guidance on financial planning and budgeting, check out these articles and guides:

- How to Create an Effective Budget Planner: A Step-by-Step Guide

- How Budget Planner save My Financial Life

- Master Your Finances with Our Monthly Budget Planner

- Financial Freedom Starts Here with Paycheck Budget Printable

- Master Your Finances With Our Budget Breakdown Planner

- Digital vs. Paper: Which Budget Planner is Right for You?

Tools and Apps That Can Help with Budget Planning

Consider using these tools and apps to aid your budget planning process:

We invite you to share your own experiences with budget planning in the comments below.

Your insights and tips can provide valuable support and inspiration to others who are embarking on their financial planning journey.

Finally, we encourage you to subscribe to our blog for more tips and updates on financial health and planning.

By subscribing, you’ll receive regular insights and advice on managing your finances, achieving your financial goals, and maintaining overall financial well-being.

Taking the first step towards better financial health can make a profound difference in your life. Start using a budget planner today and take control of your financial future.

https://www.linkedin.com/in/mariswari/

https://www.linkedin.com/in/mariswari/