Smart Strategies for Soft Savings : Building Wealth Effortlessly

maris wariShare

Soft saving refers to the practice of saving money gradually and consistently by making small, manageable adjustments to your everyday expenses and habits.

Unlike traditional saving, which often involves putting aside a fixed amount of money at once, soft saving focuses on making incremental changes that can add up over time.

The importance of soft saving in personal finance lies in its accessibility and sustainability.

By incorporating soft saving techniques into your routine, you can build a stronger financial foundation without drastically altering your lifestyle.

Let's find out why we need to adapt soft saving into our life!

Some key reasons why soft saving is important

Developing a Savings Habit.

Soft saving helps cultivate a habit of saving regularly, making it easier to set money aside for future goals or unexpected expenses.

Building Financial Resilience.

By accumulating savings gradually through soft saving, you create a financial buffer that can protect you during emergencies or economic downturns.

Achieving Long-Term Financial Goals.

Soft saving allows you to work towards larger financial goals, such as buying a home, starting a business, or retirement, by consistently setting aside funds over time.

Reducing Financial Stress.

Having savings from soft saving can provide peace of mind knowing that you have a financial cushion to fall back on when needed.

Maximizing Resources.

Soft saving helps optimize your financial resources by identifying areas where you can cut back on expenses or find savings opportunities without significant sacrifices.

Overall, soft saving is important in personal finance as it promotes financial stability, encourages mindful spending habits, and empowers individuals to take control of their financial future one small step at a time.

Building wealth effortlessly through smart strategies involves implementing financial tactics that allow your money to work for you efficiently and consistently, without requiring constant effort or hands-on management.

The key idea is to leverage smart approaches to grow your wealth gradually over time, empowering you to achieve your financial goals with minimal stress and maximum effectiveness.

By adopting smart strategies such as automation, passive income streams, diversified investments, and strategic savings techniques, you can set up a system that continuously generates wealth without the need for constant manual intervention.

This approach focuses on optimizing your financial decisions, maximizing returns, and minimizing risks to create a sustainable path to long-term wealth accumulation.

The concept of building wealth effortlessly through smart strategies encourages individuals to be proactive in managing their finances, make informed choices, and take advantage of compounding interest and growth opportunities.

By incorporating these intelligent tactics into your financial plan, you can set yourself up for financial success while enjoying the benefits of a well-designed wealth-building system that works harmoniously in the background.

Smart Strategies for Soft Savings.

Soft savings and traditional savings are both essential elements of personal finance, but they differ in their approach and implementation.

Here's an explanation of what soft savings are and how they differ from traditional savings :

Soft savings refer to the practice of gradually and consistently saving money by making small adjustments to daily expenses and habits.

This approach focuses on finding ways to cut back on non-essential spending, identifying cost-saving opportunities, and making incremental changes to save money over time.

Soft savings often involve minimizing expenses on items like dining out, entertainment, subscriptions, or unnecessary purchases, without significantly impacting one's lifestyle.

The emphasis is on cultivating a habit of saving through small, manageable steps and building up savings gradually over time.

Traditional savings typically involve setting aside a fixed amount of money at regular intervals, such as monthly or bi-weekly, into a designated savings account or investment vehicle.

This approach requires a more structured and disciplined approach to saving, where individuals commit to saving a specific percentage of their income or a set dollar amount consistently.

Traditional savings may involve setting specific savings goals, creating a budget, and actively monitoring progress towards achieving those goals.

The focus is on saving a predetermined amount of money for future needs, emergencies, financial goals, or investments.

These are key different between soft savings and traditional savings :

Approach

Soft savings focus on making gradual, incremental changes to everyday expenses, while traditional savings involve setting aside a fixed amount of money regularly.

Flexibility

Soft savings offer flexibility in terms of the amount saved and the methods used, whereas traditional savings typically follow a structured savings plan.

Ease of Implementation

Soft savings can be easier to implement as they do not require a strict savings regimen, making it more accessible for individuals who may find traditional savings challenging.

Long-Term Impact

While traditional savings provide a structured approach to achieving financial goals, soft savings can also add up over time and contribute significantly to one's overall financial well-being.

Overall, soft savings and traditional savings complement each other, and incorporating both approaches into your financial strategy can help you build a robust savings habit and work towards achieving your financial objectives effectively.

Incorporating soft savings into your financial routine can offer several benefits that can positively impact your financial well-being.

Here are some key advantages of incorporating soft savings into your routine:

Developing a Savings Habit.

Soft savings help you establish a habit of saving regularly by making small adjustments to your spending habits.

This consistent practice can lead to greater financial discipline and long-term savings success.

Building Financial Resilience.

By gradually accumulating savings through soft saving techniques, you create a financial cushion that can provide security during emergencies or unexpected expenses.

This financial resilience can help you navigate challenging times more effectively.

Achieving Financial Goals.

Soft savings can help you work towards achieving your financial goals by steadily setting aside funds over time.

Whether it's saving for a vacation, a down payment on a home, or retirement, incorporating soft savings into your routine can help you make steady progress towards your objectives.

Minimizing Impact on Lifestyle.

Soft savings focus on making small, manageable adjustments to your everyday expenses without drastically altering your lifestyle.

This means you can save money without feeling like you're making significant sacrifices, making it a sustainable approach to long-term saving.

Stress Reduction.

Having savings from soft saving can reduce financial stress and provide peace of mind knowing that you have a financial buffer in place.

This can help alleviate anxiety related to money matters and improve your overall well-being.

Maximizing Savings Opportunities.

Soft savings techniques can help you identify areas where you can cut back on expenses or find savings opportunities that you may not have noticed before.

This can optimize your financial resources and help you make the most of your income.

Incorporating soft savings into your financial routine encourages mindful spending, promotes savings consistency, and sets you on a path towards achieving your financial goals in a sustainable and effective manner.

It's a flexible and adaptable approach that can benefit individuals of all income levels and financial situations.

Related content

- How to Save $10,000 in a year with 10 Simple Real Ways

- 12 Real Way to Help You Save $1000 Every Month in 2024

- Master Your Money: 10 Reasons to Use an Income and Expense Tracker Printable

Here are some examples of soft savings techniques that you can incorporate into your financial routine:

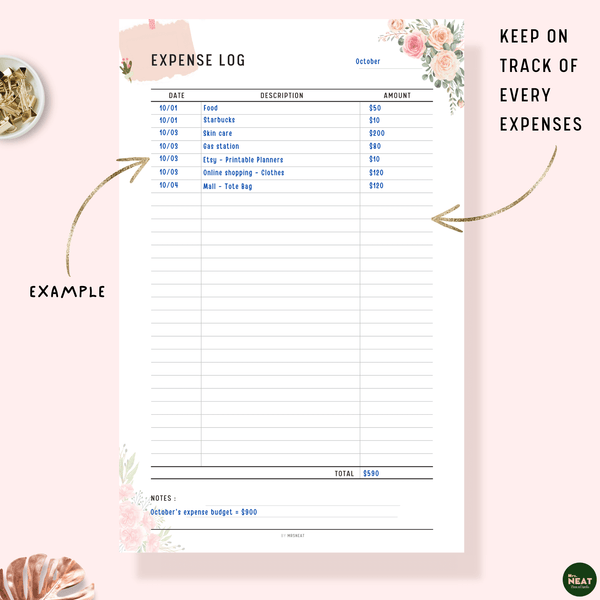

Cutting Back on Daily Expenses #1

Meal Planning

Planning your meals in advance, cooking at home, and bringing lunch to work can help you save significantly on dining out expenses.

Coffee Savings

Making your coffee at home or reducing the frequency of coffee shop visits can add up to substantial savings over time.

Energy Conservation

Implementing energy-saving practices at home, such as turning off lights when not in use, adjusting the thermostat, and using appliances efficiently, can lower utility bills.

Utilizing Cashback Rewards #2

Credit Card Rewards

Using credit cards that offer cashback rewards on purchases allows you to earn money back on your everyday expenses.

Cashback Apps

Utilizing cashback apps and websites when shopping online can help you earn cash rewards on purchases from various retailers.

Grocery Rewards Programs

Signing up for grocery store rewards programs or cashback offers can help you save money on your grocery purchases.

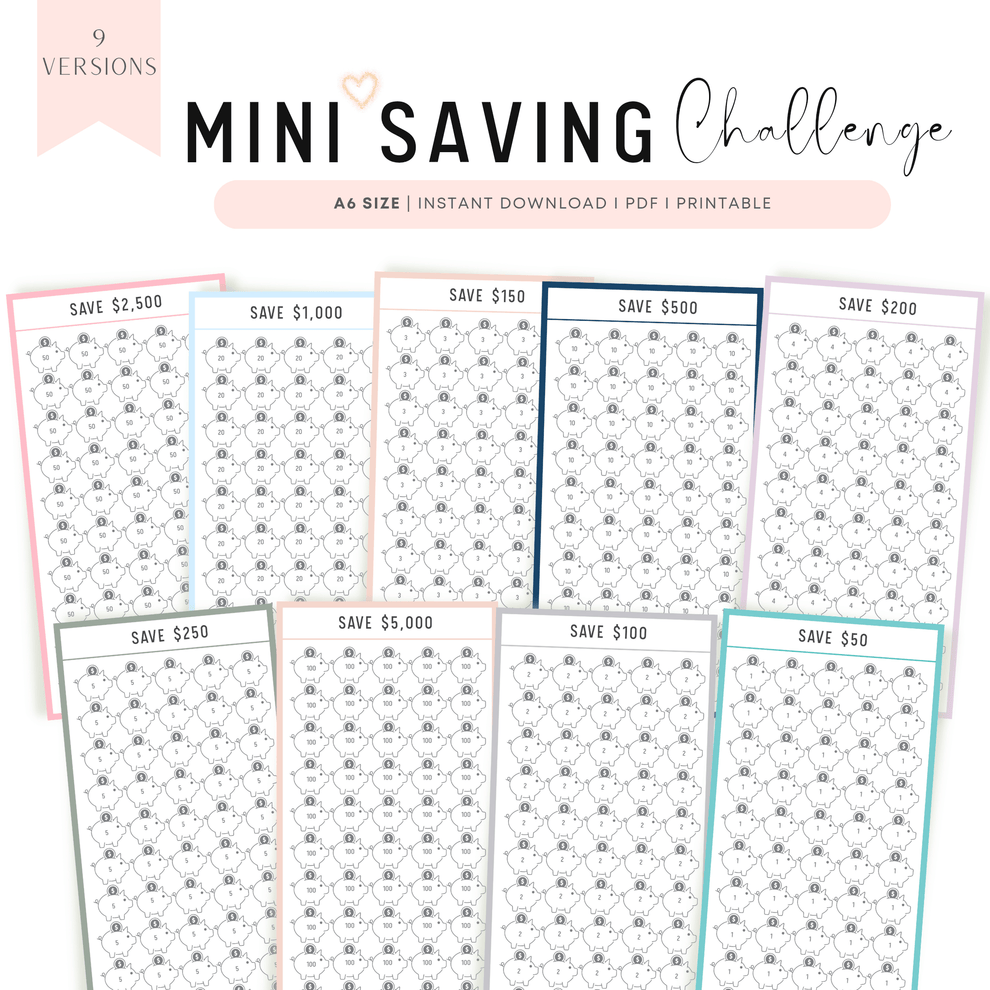

Automating Savings #3

Automatic Transfers

Setting up automatic transfers from your checking account to a savings account each month ensures that a portion of your income is saved without having to think about it.

Round-Up Apps

Using round-up apps that round up your purchases to the nearest dollar and save the spare change can help you accumulate savings effortlessly.

Employer Retirement Contributions

Taking advantage of employer-sponsored retirement plans with automatic contributions from your paycheck can help you save for retirement without needing to manually transfer funds.

By incorporating these soft savings techniques into your financial habits, you can make incremental changes that lead to significant savings over time. These strategies are practical, easy to implement, and can help you build a strong financial foundation without drastically altering your lifestyle.

Building Wealth Effortlessly

Setting specific savings goals is crucial for achieving financial success and maintaining motivation in your saving efforts.

Here are some key reasons why setting specific savings goals is important:

Clarity and Focus

Specific savings goals provide clarity on what you are working towards and help you stay focused on your target.

Having a clear goal in mind allows you to direct your financial efforts and resources effectively.

Motivation

Setting specific savings goals can be a source of motivation and inspiration as you work towards achieving them.

Knowing what you are saving for and the benefits it will bring can keep you motivated to stay on track with your savings plan.

Measurable Progress

Specific savings goals are measurable, allowing you to track your progress over time.

Seeing measurable progress towards your goals can boost confidence, reinforce good financial habits, and provide a sense of accomplishment.

Accountability

Specific savings goals hold you accountable for your financial actions.

When you have a clearly defined goal, you are more likely to make responsible spending decisions and avoid unnecessary expenses that might hinder your progress.

Financial Planning

Setting specific savings goals requires you to plan and strategize your finances.

This planning process helps you identify potential obstacles, establish a timeline for reaching your goals, and create a roadmap for achieving financial success.

Prioritization

Specific savings goals help you prioritize your financial objectives and allocate resources accordingly.

By setting goals based on your values and priorities, you can ensure that your savings efforts align with what matters most to you.

Achievement and Satisfaction

Successfully reaching specific savings goals can bring a sense of achievement and satisfaction.

Celebrating milestones along the way and achieving your desired outcomes can provide a positive reinforcement loop for continued success.

Overall, setting specific savings goals is essential for effective financial planning, long-term success, and personal growth.

By establishing clear, measurable objectives, you can enhance your financial habits, stay motivated, and work towards building the future you desire.

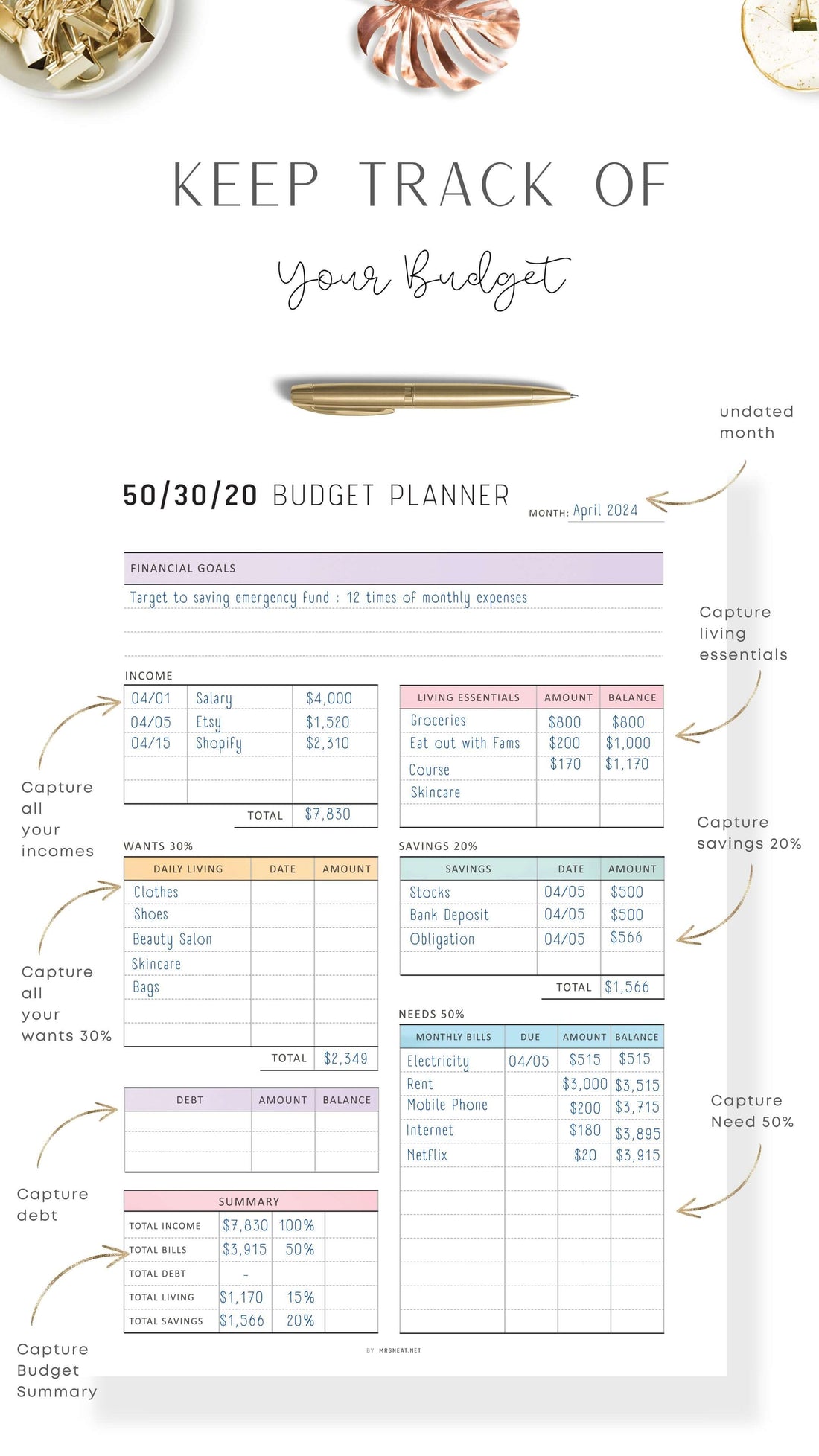

The 50/30/20 rule for budgeting is a popular guideline that suggests dividing your after-tax income into three categories: needs, wants, and savings.

Here's how the 50/30/20 rule works and how it can help with soft savings:

50% for Needs (Essential Expenses).

This category includes essential expenses that are necessary for daily living, such as rent or mortgage, utilities, groceries, transportation, insurance, and healthcare.

By allocating 50% of your income to cover these essential needs, you ensure that your basic requirements are met without overspending in this area.

30% for Wants (Discretionary Expenses).

The wants category comprises discretionary expenses that are non-essential but enhance your quality of life, such as dining out, entertainment, shopping, travel, and hobbies.

Allocating 30% of your income to wants allows you to enjoy life's luxuries while maintaining a balance between your needs and wants.

20% for Savings and Debt Repayment.

The savings category includes both saving for the future and paying off debt. This 20% allocation is crucial for building an emergency fund, investing for the long term, and reducing debt burdens.

Soft savings align well with the 20% savings component of the 50/30/20 rule, as it emphasizes consistent and gradual saving practices that help you grow your savings over time.

How the 50/30/20 Rule Helps with Soft Savings

Structured Allocation

The 50/30/20 rule provides a structured framework for allocating your income, making it easier to prioritize savings alongside your essential and discretionary expenses.

Balanced Approach

By designating 20% of your income for savings and debt repayment, the rule encourages a balanced approach to financial management, ensuring that you save consistently while also addressing your financial obligations.

Goal Setting

The 20% savings component of the rule encourages goal setting and progress tracking, aligning well with the concept of setting specific savings goals for soft savings.

This can help you stay focused and motivated to reach your savings targets.

Financial Discipline

Following the 50/30/20 rule cultivates financial discipline by establishing clear guidelines for managing your income.

This discipline can support your soft savings efforts by creating a routine and structure for saving money effortlessly.

By integrating the principles of the 50/30/20 rule into your budgeting strategy, you can effectively manage your finances, prioritize savings, and lay the foundation for successful soft savings practices that build wealth over time

The concept of "paying yourself first" is a popular financial strategy that involves prioritizing saving and investing by allocating a portion of your income to savings before paying for any other expenses. This approach emphasizes the importance of making saving a top financial priority and treating it as a non-negotiable expense.

Here's how paying yourself first works and how it can lead to consistent savings:

Prioritizing Savings.

When you pay yourself first, you allocate a specific percentage or set amount of your income to savings as soon as you receive your paycheck.

This means that savings take precedence over other expenses, including bills, groceries, or discretionary spending.

Automating Savings.

One of the key aspects of paying yourself first is automating your savings process.

By setting up automatic transfers from your checking account to a designated savings account or investment account, you ensure that a portion of your income is saved consistently without needing to make manual transfers each month.

Building a Financial Safety Net.

Paying yourself first helps you build a financial safety net and create a cushion for emergencies or unexpected expenses.

By prioritizing savings, you establish a habit of setting money aside for future needs, leading to greater financial security and peace of mind.

Consistent Savings Habits.

By making saving a priority and treating it as an essential expense, paying yourself first instills consistent savings habits.

This approach helps you develop financial discipline, stay committed to your savings goals, and avoid the temptation of spending all your income before saving.

Long-Term Wealth Building.

Paying yourself first is a strategy for long-term wealth building and financial stability.

By consistently saving and investing early on, you can take advantage of compounding interest and growth opportunities, leading to the accumulation of wealth over time.

Alignment with Goals.

Paying yourself first aligns with the concept of setting specific savings goals.

By prioritizing savings and automating the process, you ensure that you are working towards achieving your financial objectives in a proactive and structured manner.

Overall, paying yourself first is a powerful financial habit that can lead to consistent savings, improved financial well-being, and long-term wealth accumulation.

By making saving a priority and taking control of your financial future, you set yourself on a path towards achieving your financial goals and securing a stable financial future.

Conclusion

In conclusion, the key to growing wealth effortlessly lies in leveraging the power of compounding interest, exploring passive income streams, and maintaining motivation and discipline in your savings journey.

Firstly, compounding interest plays a pivotal role in wealth accumulation by allowing your savings to grow exponentially over time.

By reinvesting earned interest and returns, you can harness the compounding effect to accelerate the growth of your wealth effortlessly.

The earlier you start saving and investing, the more significant the impact of compounding interest on your long-term financial success.

In addition to compounding interest, passive income streams can serve as a valuable complement to your soft savings efforts.

Passive income entails earning money with minimal active involvement, such as rental income, dividends from investments, or royalties from intellectual property.

By diversifying your income sources and generating passive income, you can boost your savings potential and create additional wealth-building opportunities.

Finally, staying motivated and disciplined in your savings journey is essential for long-term financial success.

To maintain focus on your savings goals, consider setting specific, measurable objectives and tracking your progress regularly.

Celebrate milestones along the way, reward yourself for achieving goals, and visualize the financial freedom and security that your savings efforts will afford you.

Surround yourself with supportive peers or seek accountability partners to stay motivated and accountable in your saving endeavors.

By harnessing the power of compounding interest, exploring passive income opportunities, and cultivating motivation and discipline in your savings approach, you can pave the way for sustainable wealth growth and financial security.

Remember, consistency, perseverance, and a long-term perspective are key to achieving your financial goals and building a strong foundation for a prosperous future.

https://www.linkedin.com/in/mariswari/

https://www.linkedin.com/in/mariswari/